October was National Domestic Violence Awareness Month. Have you ever heard of the Blue Campaign? The Blue Campaign is a national public awareness campaign designed to educate the public, law enforcement, and other industry partners to recognize the indicators of human trafficking and how to appropriately respond to possible cases. Blue Campaign’s educational awareness objectives consist of two foundational elements, prevention of human trafficking and protection of exploited persons.

It is difficult to prevent or identify human trafficking if you don’t know what it is or its indicators. Human trafficking involves the use of force, fraud, or coercion to obtain some labor or commercial sex act. Every year, millions of men, women, and children are trafficked worldwide – including right here in the United States. It can happen in any community, and victims can be any age, race, gender, or nationality. Traffickers might use violence, manipulation, or false promises of well-paying jobs or romantic relationships to lure victims into trafficking situations.

Language barriers, fear of their traffickers, and fear of law enforcement frequently keep victims from seeking help, making human trafficking a hidden crime.

Traffickers use force, fraud, or coercion to lure their victims and force them into labor or commercial sexual exploitation. They look for people who are susceptible to a variety of reasons, including psychological or emotional vulnerability, economic hardship, lack of a social safety net, natural disasters, or political instability. The trauma caused by the traffickers can be so significant that many may not identify themselves as victims or ask for help, even in highly public settings.

Recognizing key indicators of human trafficking is the first step in identifying victims and can help save a life. Here are some common indicators to help understand human trafficking. You can also download or order the Blue Campaign indicator card, which is a small plastic card that lists common signs of traffic and how to report the crime.

· Does the person appear disconnected from family, friends, community organizations, or houses of worship?

· Has a child stopped attending school?

· Has the person had a sudden or dramatic change in behavior?

· Is a juvenile engaged in commercial sex acts?

· Is the person disoriented or confused, or showing signs of mental or physical abuse?

· Does the person have bruises in various stages of healing?

· Is the person fearful, timid, or submissive?

· Does the person show signs of having been denied food, water, sleep, or medical care?

· Is the person often in the company of someone to whom he or she defers? Or someone who seems to be in control of the situation, e.g., where they go or who they talk to?

· Does the person appear to be coached on what to say?

· Is the person living in unsuitable conditions?

· Does the person lack personal possessions and seem not to have a stable living situation?

· Does the person have freedom of movement? Can the person freely leave where they live? Are there unreasonable security measures?

Not all indicators listed above are present in every human trafficking situation, and the presence or absence of any of the signs is not necessarily proof of human trafficking. The best thing all of us can do for victims of Human Trafficking is to remain aware of the condition and, more importantly, if we see something, say something. Anonymity can be maintained. To report suspected human trafficking, there are many avenues of reporting:

–National Human Trafficking Hotline…1-888-373-7888;

–National Center for Missing & Exploited Children…1-800-843-5678;

–Call 911; or

— Text HELP or INFO TO BeFree (233733).

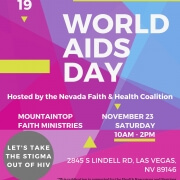

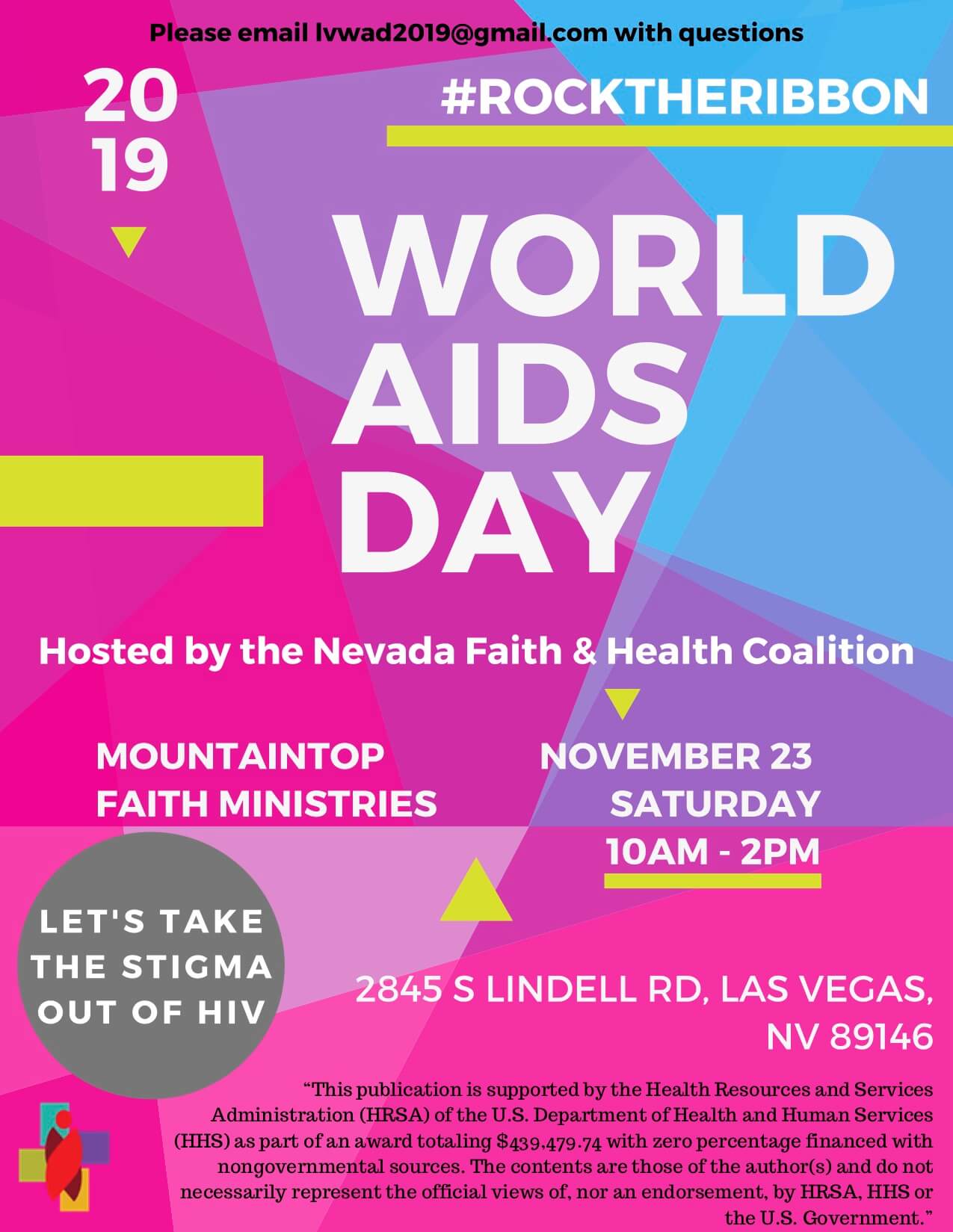

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton HouseCheck schedule for services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2025 Check schedule for special services