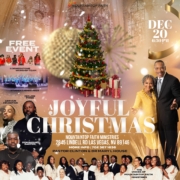

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

A Time of Prayer 8:30am (on campus) 1st Sundays (Feb-Oct)

Worship Service On - Campus & Online

9 am & 11 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House6:45 pm PST On Campus & Online (check schedule)

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 8:30 am (on campus)

1st Sundays (Feb-Oct)

Worship Service On-Campus & Online

9 am & 11 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

6:45 pm PST

On campus & Online )