The Importance of Life Insurance

One of the worst things I have witnessed in recent weeks is a family that had a member pass unexpectedly. There was no insurance, no will, no trust, and no money for the burial. And to make matters worse, the surviving family didn’t have enough money to pay for funeral expenses. So the grieving family is left with having to raise or borrow the money in the midst of dealing with all the emotions and stress of losing a loved one. This scenario is so very sad, but it is all too common. It is a horrible situation and I truly feel for anyone going through it. Although this is not a pleasant topic, it must be discussed.

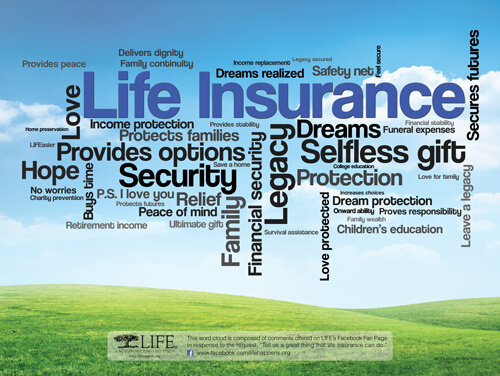

Have you ever considered what would happen to the people that depend on you if the unthinkable were to happen? Where would they live? How would they survive without your income? This can be a sobering thought; it is all too real. Life insurance is meant to ease the financial burden of a loss of income due to death, illness, or even an accident. In the case of someone getting hurt and losing their ability to work, somehow, the bills must be paid. And life insurance helps to bridge those gaps.

Basically, there are three types of life insurance policies. There is term life, whole life, and universal life, and it is extremely important to know the difference. Term life policies have a face value (how much it is worth in dollars) and offer protection for a particular time or term. For example, a term life policy may have a $200,000 value face value for 20 years. So, if the insured person were to die within the term, the beneficiary (person receiving the money) would inherit $200,000. After the policy term expires, if the insurance is not renewed, the insured person no longer has life insurance. Whole life policies are also a face value, but they don’t have an expiration date. As long as insurance premiums (or bills) are paid, a person has insurance. Universal life insurance has a face value, and also doesn’t expire although it has may more options. There can be all kinds of “features” such as savings plans, and investments included into a policy.

So which insurance is the best for you? I recommend term life insurance. Why? Term life insurance is much cheaper. It offers you “more bang for your buck”. With term life, the insurance is only responsible for paying out money within the designated term. Whole life is more expensive because, the insurance company, again as long as the premiums are paid, will have to pay out money at some time. Universal life is expensive because it also doesn’t expire and has options. You pay for the option of having savings plans and investment opportunities within a life insurance policy. I recommend keeping your insurance separate from your investments. Let your insurance be only insurance.

How much life insurance should I get? I would recommend 10-12 times your annual salary. I know that seems like a lot of money, but consider the following. If a husband making $40,000 a year, has a life insurance policy of $200,000, if he were to pass, his income would be replaced for about 5 years. What about year 6? Now what if the same husband has an insurance policy for $500,000? Upon his death, if that money is invested and does just average (around 7%), that husband’s income can be replaced for 30 years!

In Isaiah 38, God told King Hezekiah, he was going to die soon and to “get his affairs in order.” Do you know when you are going to die? Of course not! That is why you need to get life insurance now! If God told Hezekiah to do it, surely he wants you to be prepared for your home-going. So do the right thing and spare your loved ones any unnecessary stress. If you don’t have life insurance, get some! If you already have life insurance, review your policy and make sure it is what you want and need. May peace be with you all, God bless!

Leave a Reply

Want to join the discussion?Feel free to contribute!