Alfred King

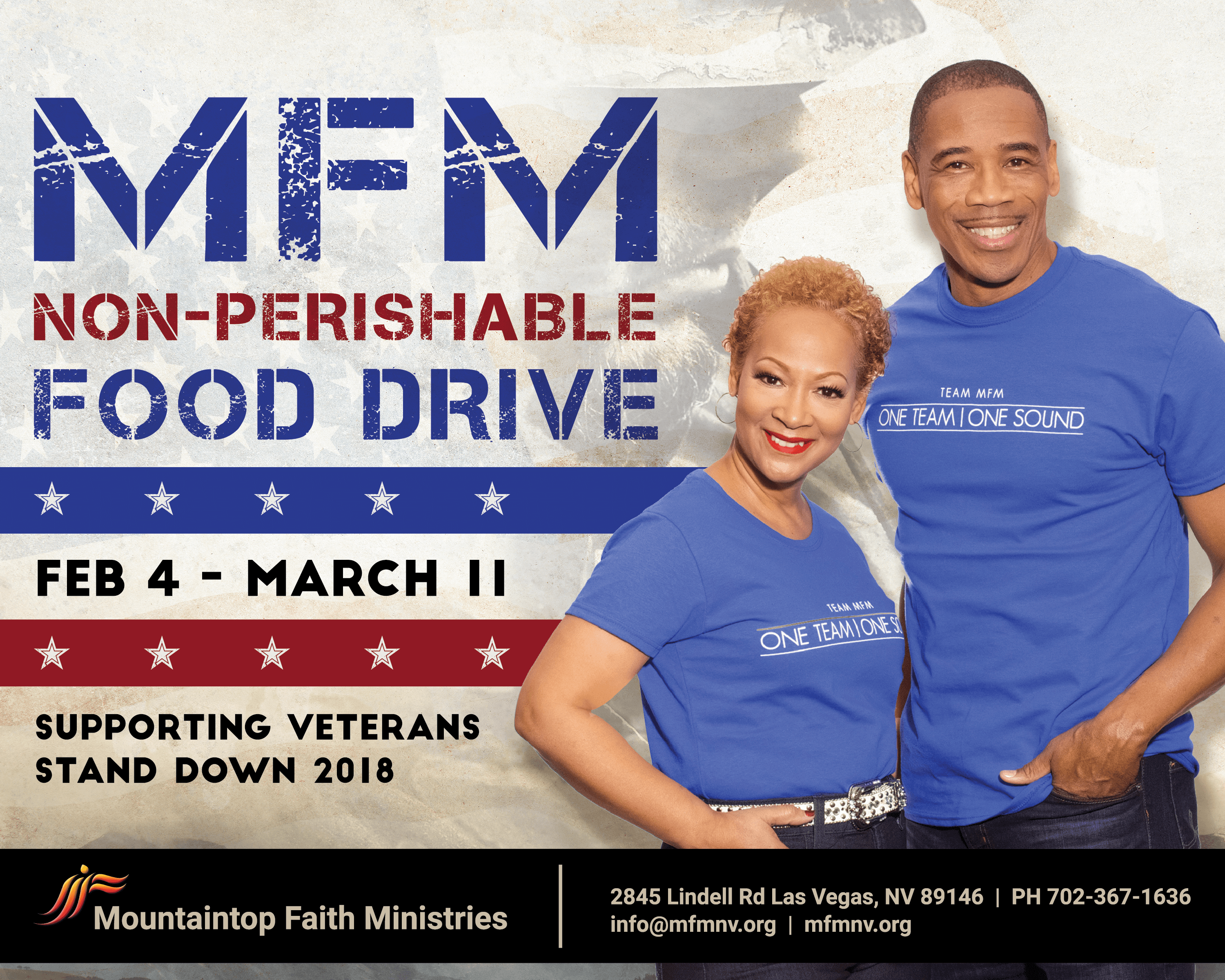

Veterans Food Drive

/in Community, Past Events/by Andrea SolidItems Needed

Peanut Butter Spaghetti Sauce

Peanut & Cheese Crackers Pop-top canned fruits & vegetables (pull tab)

Beef Jerky Macaroni & Cheese

Apple Sauce Individually Packaged chips/pretzels0Goldfish

Pudding Boxed Drinks, juice and water

Fruit Cups Vienna Sausages (with pull tab)

Granola Bars Pop Tarts

Power Individual Packets of Oatmeal

Cereal Bars Plastic Spoons

Single serving items of Chef Boyardee Items Gallon Sized Ziploc Bags

Ravioli/ Spaghetti – O’s Fruit Snacks

Single Serving Soups (with pull tab) Dried Fruit

Tomato Juice Trail Mix

Packaged Nuts Any kind of pasta

Fresh Wind

/in From the Desk of Pastor House, Past Events/by Andrea SolidJANUARY 2018

HAPPY NEW YEAR…it is 2018, the Year that we are decreeing according to Acts 2:2 the power of the “Fresh Wind”. I believe that this will be an exceptional year of the Lord’s favor in 3 dimensions: Spirit, Power, and Abundance. We will arise like a mighty army with victory and the authority to conquer. I know by a witness in my spirit that this will be a year of great manifestation of God’s hand. It is so important that we trump through every misconception of who we are in Christ Jesus, and realize that the past of the former years cannot be a deterrent of us moving forward and taking major faith steps towards our purpose. Begin this year with a perpetual praise and being persistent about framing your world with Words of faith, stay consistent in prayer, reading the word of God, fasting and holding on to what God has promised us, will cause us to have a second wind to complete the course. You must hold on to your Faith in 2018!

In Hebrews 11:6 Amp it reads:

“ But without faith, it is impossible to [walk with God and] please Him, for whoever comes [near] to God must [necessarily] believe that God exists and that He rewards those who [earnestly and diligently] seek Him.”

I love the word reward. A reward is a recompense for a worthy act. God loves to reward and benefit you for diligently seeking Him.

Learn to live the lifestyle of pursuing the things of God, putting him first in your life, and raising your expectation level.

The things you are thankful for are the things that God will multiply in your life; begin this year honoring God through gratefulness. Put Him first every day.

Words create your daily experiences. Words are containers of expectation. They are filled with possibilities. Possibilities come as you change the way you think. Words have a powerful effect on the atmosphere around you. Get excited about your words. Your Words will be bringing your breakthrough. Your Words are renewing your strength. Your Words are bringing your abundance and your Words are restoring your health.

Words are powerful tools that open and close doors. Every time you change the way you speak, you open a whole new world of opportunities. Words are powerful tools for changing your life. Your reward is closer than you think…This year 2018, we the Body of Christ will see the hand of the Lord move mighty in our lives, this will be an incredible year of favor, increase, strength, creativity and renewed passion to pursue our dreams.

13“Behold, the days are coming,” says the Lord, “When the plowman shall overtake the one who gathers the harvest, and the one who treads the grapes [shall overtake] him who sows the seed [for the harvest continues until planting time]; When the mountains will drip sweet wine. And all the hills shall melt [that is, everything that was once barren will overflow with streams of blessing].

14 “Also I shall bring back the exiles of my people Israel, and they will rebuild the deserted and ruined cities and inhabit them: They will also plant vineyards and drink their wine, And make gardens and eat their fruit.15

“I will also plant them on their land, And they shall never again be uprooted from their land. Which I have given them,” Says the Lord your God. Amos 9:13-15

Pastor Clinton House

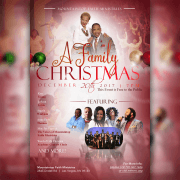

Merry Christmas from Our Hearts to Yours

/in From the Desk of Pastor House, Past Events/by Andrea SolidWhile we’re opening our gifts, enjoying the company of our friends and family, celebrating the memories, as we gather around the dinner table to eat great food and the warmth of laughs, please let us take one moment to remember the true meaning of Christmas, “Jesus”.

Wishing you and yours a Blessed and Merry Christmas – Pastor Clinton & Dr. Mary L. House

23 “Behold, THE VIRGIN shall be with child and give birth to a Son, and they shall call His name Immanuel” which, when translated, means, “God with us.” 24 Then Joseph awoke from his sleep and did as the angel of the Lord had commanded him, and he took Mary [to his home] as his wife, 25 but he kept her a virgin until she had given birth to a Son [her firstborn child]; and he named Him Jesus (The Lord is salvation).

Matthew 1:23-25 (AMP)

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton HouseCheck schedule for services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2025 Check schedule for special services