In Nevada, a landlord can’t begin an eviction lawsuit without first legally terminating the tenancy. This means giving the tenant written notice, as specified in the state’s termination statute. If the tenant doesn’t move (or reform—for example, by paying the rent or finding a new home for the dog), you can then file a lawsuit to evict. (Technically, this is called an unlawful detainer, or summary eviction, lawsuit.)

Nevada law sets out detailed requirements to end a tenancy, with different types of termination notices and procedures required for different types of situations. This article provides an overview of the rules landlords must follow when evicting a tenant or ending a tenancy in Nevada.

Notice of Termination With Cause

Nevada allows a landlord to terminate a tenancy early and evict a tenant for a number of reasons, including not paying rent, violating the lease or rental agreement, or committing an illegal act. The reason for the eviction will determine the type of notice the landlord must give to the tenant.

Five-Day Notice to Pay Rent or Quit: If the tenant fails to pay rent when it is due, the landlord can give the tenant a five-day notice to pay rent or quit. This notice informs the tenant that the tenant has five days to pay rent in full or move out of the rental unit. If the tenant does not pay rent or move, the landlord can file an eviction lawsuit with the court at the end of the five days (see NRS § 40.253).

Five-Day Notice to Cure or Quit: If the tenant violates a portion of the lease or rental agreement and the violation can be fixed, then the landlord can give the tenant a five-day notice to cure or quit. This notice informs the tenant that the tenant has five days to fix the violation or move out of the rental unit. If the tenant does not comply with the notice, then the landlord can file an eviction lawsuit at the end of the five days (see NRS § 40.2516).

Unconditional Quit Notice: This type of notice informs the tenant that the tenant must move out of the rental unit immediately. It does not give the tenant any time to fix the violation, and if the tenant does not move out immediately, the landlord can go straight to court and file an eviction lawsuit. The landlord can use an unconditional quit notice only when:

the tenant has assigned or sublet the rental unit in violation of the lease or rental agreement

the tenant has caused substantial damage to the property

the tenant has permitted or created a nuisance at the rental unit

the tenant has caused injury or damage to other tenants of the property or adjacent buildings or structures, or

the tenant has been in unlawful possession for sale, manufacture, or distribution of illegal drugs.

Notice for Termination Without Cause

The rules for terminating a tenancy without cause vary depending upon whether the tenant has a month-to-month rental agreement or a fixed-term lease.

Month-to-Month Rental Agreement

With a month-to-month rental agreement, the landlord must give the tenant at least a 30-day written notice informing the tenant that the tenancy will expire at the end of 30 days and the tenant must move out of the rental unit by that time. The same type of notice is required for a week-to-week agreement, except the landlord only needs to give the tenant seven days’ notice.

If the tenant is over 60 years old or has a physical or mental disability, the tenant may request an additional 30 days to move out of the rental unit. If the tenant requests this extension, the landlord must allow it (see NRS § 40.251).

Fixed-Term Lease

A landlord can only remove a tenant without cause at the end of the time specified in the lease agreement. The landlord may not be required to give the tenant notice for leases that are longer than month-to-month unless the lease agreement requires it. This means that if the tenant has a year-long lease that expires in December and the tenant has not requested a lease renewal, the landlord will not need to give the tenant notice to move out by the end of December unless the terms of the lease specifically require it.

A tenant may decide to fight the eviction, which could add time to the eviction lawsuit. The tenant could have several potential defenses, including mistakes the landlord made during the eviction process, such as using the wrong form or improperly serving it. The tenant could also assert that the landlord failed to maintain the rental unit and that the termination is retaliatory because the tenant filed a complaint about uninhabitable premises, or that the landlord discriminated against the tenant in some way.

REMOVAL OF THE TENANT

The only way a landlord can legally evict a tenant is by filing an eviction lawsuit, also called an unlawful detainer suit, with the justice court of the county in which the rental unit is located. Even if the landlord wins this lawsuit, the landlord still must not personally evict the tenant. The court will give authority to a sheriff or constable to evict the tenant by a certain day.

Nevada law has made it illegal for the landlord to personally remove the tenant from the rental unit. If the tenant has abandoned the property and left behind personal belongings, either because of receiving notice or after the eviction, the landlord can dispose of the property only after storing the property for 30 days and making efforts to locate and notify the tenant of the landlord’s intent to dispose of the property.

Prayer is one of the things the enemy tries to keep the believer from doing, because even he knows the POWER prayer holds. Prayer can sometimes be viewed as a dutiful task; however, through seeking God and establishing true relationship with Him, the believer finds prayer to be a lifestyle, relationship, and communication with the Father. Prayer was the only thing recorded that the disciples sought from Jesus. They had the opportunity to ask Jesus anything, and they asked, “Master, teach us to pray”.

There is a certain freedom experienced when you choose to live debt-free. It seems like when I talk to people about being debt-free, a very common response I get sounds something like the following: “Well, I’m not debt-free, but I’m good with money.” This common response calls me to dig a little deeper so I inquire a little harder and ask, “What do you mean, by ‘you are good with money’?” And in response, I hear, “I mean, I can pay my bills”. Debt is so common in our society we don’t think anything of it; as long as we can pay the bills. Unfortunately, that has become the new hallmark of financial fitness. This is a popular ideology adopted in our culture today, and if it is not corrected, it will have generational consequences. But before we dive into that, let’s see what the bible says about debt.

Proverbs 22:7 says, “The rich ruleth over the poor, and the borrower is servant to the lender.” It is interesting that the Bible uses such strong language when the writer chose to use the word “slave”. I don’t want to be a slave to anybody or anything! Thanks to Jesus Christ, by the way of Calvary and the 13th Amendment, I am not a slave to anything or anybody (if I choose not to be). However, when we choose to “put something on credit”, or finance a purchase, and yes, even take “same as cash” offers, we chose bondage. We make ourselves servants or, to stick with the strength of the biblical language, we choose slavery. Why would you choose bondage?

Poor choices, unabated, grow into poor behaviors which are perpetuated to the next generation. That is how generational curses get started. I know some people might not believe in generational curses, but they do exist. Everybody knows of a group of people or a family that seems to struggle with a vice whether it’s poverty, alcoholism, or gambling; and that same vice is present in multiple generations. Are they cursed? Are some of the hurdles they face the result of poor decisions being repeated generation after generation? If this is the case, they are choosing to be cursed; they are cursing themselves. Some curses can be broken simply by making better life choices.

And so it is with money choices. If you choose debt, (i.e. credit cards, finance charges, etc.) you are choosing to live under a curse; the curse of being obligated to man.

Being debt free means I am choosing to possess the freedom available to me. I am choosing to go against “the normal” practices and “conventional” ways of handling money. I am choosing to prioritize my financial obligations over my wants. I am choosing my fiscal responsibilities over my exaggerated desires. I am choosing to save money to make purchases, although it may take longer, instead of settling for the quick option of credit. I am choosing to sacrifice now, so I can win this money game later. I am choosing a little pain for my later gain. I am choosing to handle my finances biblically and be a good steward. I am choosing to be obedient to the order of God to owe no man but to love him (Rom. 13:8). I am choosing liberty over slavery.

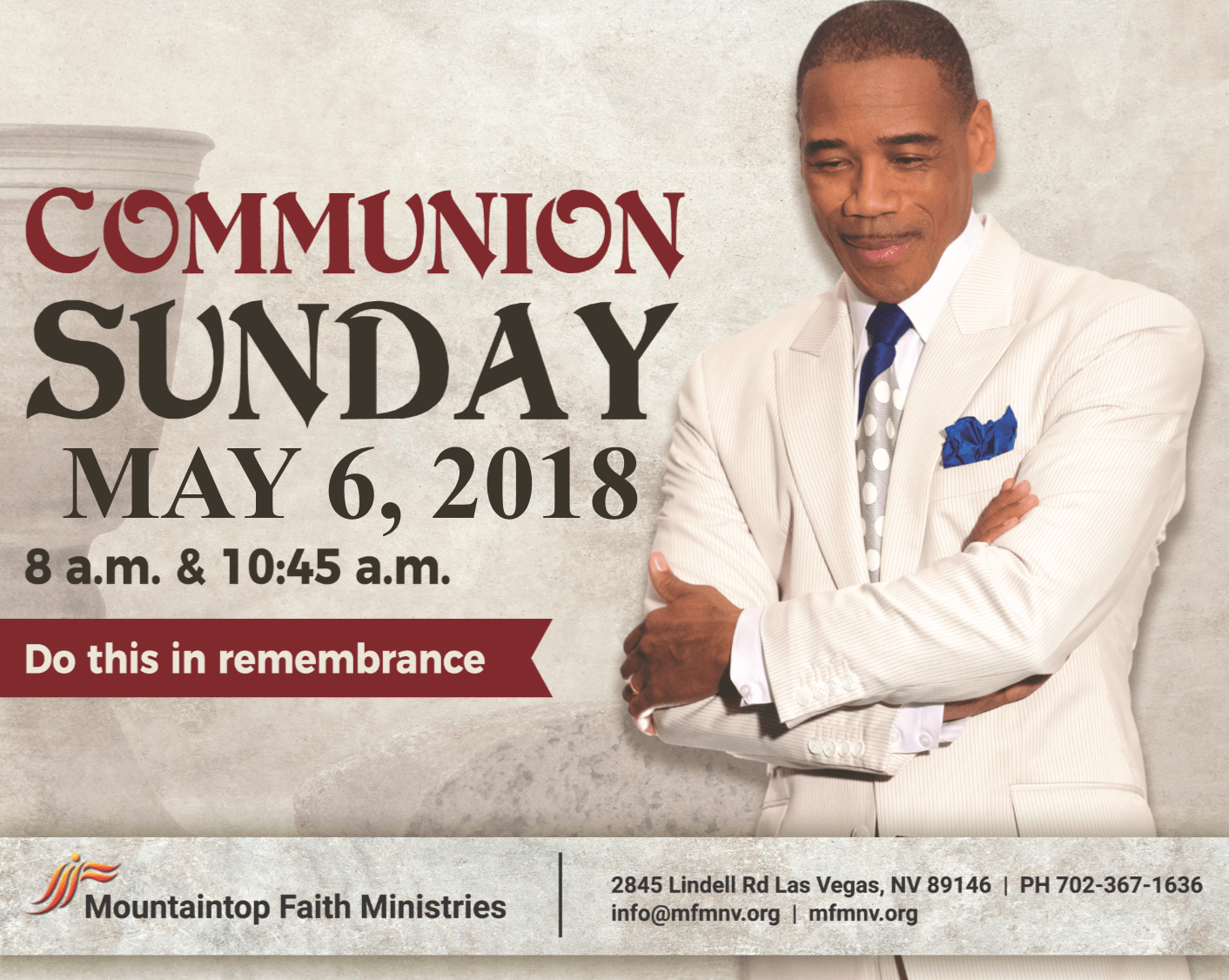

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton HouseCheck schedule for services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2025 Check schedule for special services