Well, 2017 is over and here we are at the start of 2018! That was fast! Life seems to move faster these days and partly because of the abundance of information we are exposed to on a daily basis. We live in a time where we can, in the blink of an eye, immediately find some seemly relevant article, posting, or even blog on anything we want. But there are pros and cons to the speed of this dispensation we live in that has been called the Information Age. On the positive side, data research and sharing that used to take days to complete can be done in seconds! Long gone are the days of libraries and the Dewey decimal system being the primary use of research. And if you don’t know what the Dewey decimal system is, you just made my point! Times have changed, and information is moving at the speed of light. With data being shared so fast, complex problems can be solved much faster because many more minds can collaborate more quickly. On the negative side, if we are not careful, we can become susceptible to information overload. Information overload happens when a person or group of people is exposed to too much data.

With information given so freely and easy to access, there is never a dearth of opinions on how one should handle your money; everyone has an opinion! And with information coming at us so fast and with such anonymity, it can be extremely difficult to rightly decipher good advice from bad advice. Trying to get the best financial advice can be nerve wrecking. It can be so overwhelming that some of us tend to believe what we hear most often or we tend to give extra credence to people we admire or trust regardless of their financial credentials. But what if the person (or people) we are taking our financial direction from is lost themselves? We literally become the blind following the blind. And we know how where they end up; falling in a ditch.

When it comes to financial advice, first start with the Word of God! Ask yourself, “What does God say about this?” If the advice is unethical, immoral, or if it can really hurt you financially if things go wrong, then stay away! You have to protect yourself and your financial progress. Sacrificing your integrity is never a worthwhile short-cut. Secondly, consider the source of this advice. How financially successful is the source of this information? Are they were you want to be? Are they following the advice themselves, and if so, is it working for them? How are they going to prosper if you take their advice? Watch out for wolves that speak the language a sheep wants to hear! Oh, and in case you are wondering, the authors of this article have paid off over $100,000 in consumer debt and we are totally debt free! Thirdly, ask yourself, “Is it too good to be true?” Everyone likes to get what they want in a hurry, but the bible warns against quick riches (Proverbs 13:11). Jim Rohn once said, “Success is neither magical nor mysterious. Success is the natural consequence of consistently applying basic fundamentals.” And finally, get at least one other opinion from someone you trust to give you good financial advice (so your shopping friend or your favorite cousin or aunt might not be the best choice for advice). A second opinion might provide a fresh prospective, some insight, or more information that will help you make the best decision. Remember, safety is found in the multitude of counselors (Proverbs 11:14).

I know everyone that gives financial advice does not have malicious intent, but good intentions from good people does NOT mean you are getting good advice! Some people just don’t know any better, and they don’t know they don’t know better, so charge it to their head and not their heart. But it is up to you to be discerning and regulate their influence in your financial life. Poor financial decisions can seriously slow down your progress and can take years to recover from. So choose wisely who you allow to speak into your financial future. God Bless.

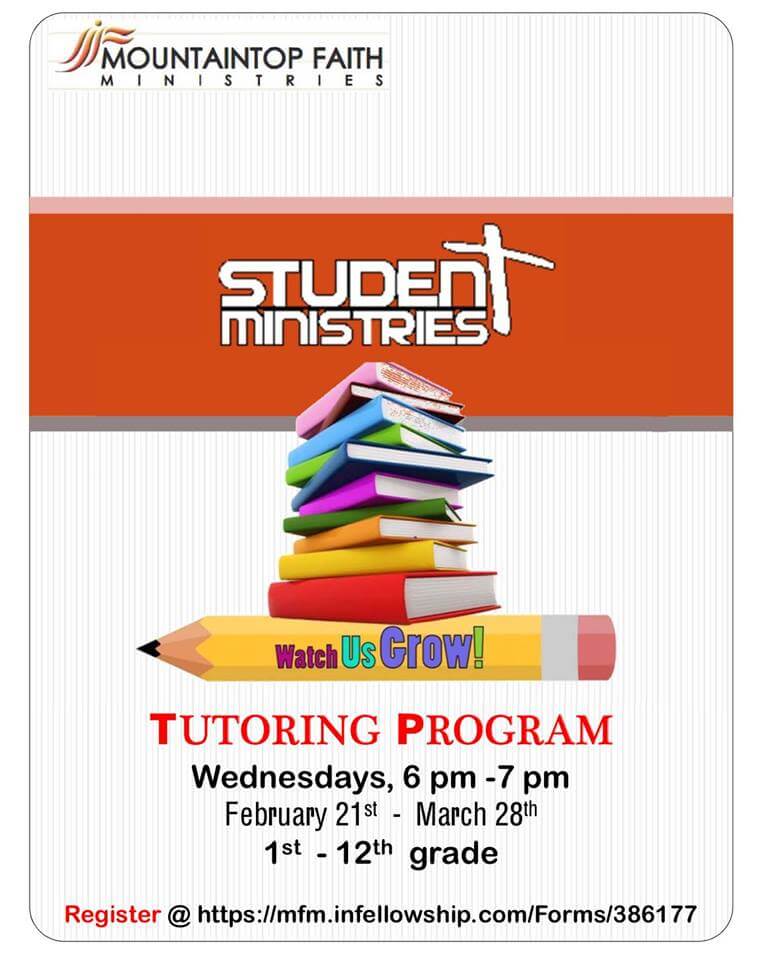

Student Ministries Tutoring Program

/0 Comments/in Past Events/by Andrea SolidIs your student in need of a tutor? LET US HELP! WE WANT TO HELP! Student Life Ministries has a FREE EXCLUSIVE TUTORING Program designed with your child in mind. This curriculum was created to help increase your child’s academic ability. We care about your child’s SUCCESS. Register your child TODAY, by clicking on the registration link, and please share this information!

https://mfm.infellowship.com/Forms/386177

Many people I encounter think that Nevada employers need to have a good reason to fire you, but that simply is not true. The truth is they just need to not have a “bad reason” to fire you. “At-will employment” is an employment relationship in which you may fire your employee at any time for any reason and your employee may resign at any time for any reason. This is the default employment relationship in Nevada, absent an employment contract with specific terms.

In an at-will employment position, you can quit whenever you want without giving notice, just like your employer can fire you whenever it wants (subject to some limitations discussed below) without notice. It seems unfair when you’re on the wrong end of an arbitrary termination, but it doesn’t seem unfair when you quit your job to get higher pay somewhere else. If you were subject to an employment contract, you could be denied the opportunity to take that higher paying job or you could theoretically owe money to your employer for the costs incurred by you breaking your contract. So I always tell people to be careful what you wish for – employment contracts aren’t always everything they’re cracked up to be.

Nevada has some exceptions to the at-will employment doctrine, however, that can potentially protect you: implied contracts and public policy exceptions. Implied contracts arise when your employer, through written or oral communications, indicates to you that your job is secure in some way. These types of implied contracts can be found in a variety of circumstances, such as when an employer states that you will only be fired for just cause, if the employee handbook includes a finite list of reasons for which you can be terminated, or if your employer pledges to only terminate you after progressive discipline is enacted.

There are also federal, state and local anti-discrimination laws that prohibit adverse action based on any legally protected classification. Protected classes are broadly defined to include, race, color, sex, age, national origin, disability, military service, and more.

Public policy exceptions are situations where a court determines that Nevada has a strong interest in stopping someone from being fired for some act. Reporting illegal behavior, refusing to violate the law, or filing a worker’s compensation claim are a few of these exceptions. If you think you were fired illegally, talk to a Nevada employment attorney. An attorney can help you sort through the facts and assess the strength of your claim. Whether you want to try to get your job back, negotiate a severance package, or sue your employer in court, an attorney can walk you through your options and help you decide how best to proceed.

Tanika M. Capers, Esq.

Have you ever heard the one about the billionaire who lives in a modest home?

That billionaire is Warren Buffett, who Forbes estimates has a $75.6 billion net worth according to Forbes World’s Billionaire List of 2017. His house? It’s not a sprawling 30,000-square-foot beachfront mansion. No, he lives in a quiet Omaha neighborhood in a $850,000 home that he bought for $31,500 in 1958.

Sure, for most people, living in an $850,000 home is a pipe dream. But if you think about a house like that being occupied by the second richest man in the world . . . it’s pretty surprising, isn’t it?

Warren Buffett could buy any house in the world (with cash!), but he chooses to live in a modest, relatively small home in Omaha. Why is that?

It’s a surprising fact that, according to Thomas Stanley’s book The Millionaire Next Door, “more than 80% [of U.S. millionaires] are ordinary people who have accumulated their wealth in one generation.” The book goes on to say that most millionaires don’t look the part. Most live in normal, middle-class neighborhoods and drive modest cars.

So what can you learn from these millionaires (and even billionaires like Warren Buffett) who don’t live the stereotypical life of a millionaire?

1. They’re avid readers.

President Harry Truman once said, “Not all readers are leaders, but all leaders are readers.” In The Millionaire Next Door, Stanley says that the average millionaire reads one nonfiction book per month.

You get the idea. One of the reasons millionaires become millionaires is because of their constant desire to learn. To them, leadership books and biographies are much more important than the latest hit reality show. When they have free time, they use it wisely—by reading.

2. They understand delayed gratification.

In other words, the average millionaire has spent most of their life sacrificing temporary pleasures for long-term success. They have no problem buying an older, used car, living in a modest neighborhood, and wearing inexpensive clothes. Keeping up with the Joneses isn’t a priority for them.

Those lifestyle decisions allow them to do things like save for retirement and college and build up a large down payment for their dream home. They realize that instant gratification is fun—but delayed gratification is so much better. Today’s sacrifices set them up for tomorrow’s success.

3. They stay away from debt.

The idea of “debt as a tool” is foreign to the average millionaire. If they want something they can’t afford, they save and pay cash for it later.

Car payments, student loans, same-as-cash financing plans—these just aren’t part of their financial plan, and that’s why they win with money. They don’t owe anything to the bank, so every dollar they earn stays with them to spend, to save, and to give.

Debt is the biggest obstacle to building wealth. Run from it every chance you get.

4. They budget.

Your budget is your plan, and you don’t build a net worth of a million dollars without some sort of plan.

Just like you build a house by starting with the foundation, you build wealth by starting with the budgeting basics. And then you keep following them. When you’re making a lot of money, you don’t stop managing it, right?

The average millionaire has made a habit of budgeting every month. They know what’s coming in and what’s leaving their bank account. To this day, Dave Ramsey and his wife still make a monthly budget—a practice they started decades ago. If you only remember one thing, remember this: Budgeting is the key to winning with money.

5. They give.

Sure, some rich people can be selfish jerks—just like anyone else. But the everyday millionaires who live down the street, the ones you don’t even realize are wealthy, are some of the most giving people you’ll ever meet.

Whether it’s tithing at church, donating to a meaningful charity, or just giving to friends and family on occasion, these people have a caring spirit. They realize that the most important thing you can do with wealth is help others. That’s actually why they continue building their wealth. They realize they can’t take it with them when they die. But instead of frivolously spending it all, they choose to leave a legacy for the people who mean the most to them.

This idea that wealthy people always live in ivory towers and wear $500 jeans is a myth. Being successful with money is as simple as living a modest lifestyle that follows a few basic principles.

The more of these habits you follow, the more successful you’ll be with money. Just ask Warren Buffett.

Retrieved from https://www.daveramsey.com/blog/habits-of-millionaires-and-billionaires

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton HouseConcluded for 2024 Check schedule for special services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2024 Check schedule for special services