Middle-Class Millionaire.

No, that’s not a typo. And it’s not a myth or a fairy tale.

A middle-class millionaire is a real thing—or, rather, a real person just like you and me.

Despite what you’ve seen on the news or social media, middle-class people can become millionaires. In fact, anyone can—yes, even you. I have the stats to prove it. And I have a plan you can follow to get there.

HOW DID MOST MILLIONAIRES GROW UP?

This year, my team released the findings from the largest study of millionaires ever conducted—more than 10,000 people. One of the things we discovered is that most millionaires didn’t grow up in wealthy families. Rather, 8 in 10 millionaires we surveyed said they come from families at or below the middle-class income level.

When we break that down, 48%—almost half of all millionaires—described their parents’ household as middle class, 27% described it as lower-middle class, and over 4% of them described it as lower class.

Let those stats sink in. Half of millionaires come from middle-class homes. And one in four come from the lower-middle class. America, this is your wake-up call. The American Dream is alive and available. You just have to work for it.

HOW TWO PEOPLE LIKE YOU BECAME MILLIONAIRES

As a part of our research, we asked these everyday millionaires to tell us their stories. Here’s one such story that proves your background doesn’t matter:

Thomas grew up in the Midwest and started with literally nothing. In fact, he remembers only having two shirts and two pairs of pants for a long stretch of his childhood. He came from a dysfunctional family with an alcoholic father and a mother who struggled with mental health issues. As a result, he was in and out of three or four different foster homes as a child, and both of his parents died far too young. Those early years taught him two important lessons: First, he learned that drinking alcohol would lead him away from future success, and second, he knew that he did not like being poor. Despite coming out of poverty, loss, and hardship, Thomas had a clear vision for where he wanted his life to go, but he knew he’d have to work for it.

Thomas went to college in the 1960s and graduated with a math degree before being drafted into the Vietnam War. After serving four years, he returned to school to pursue a Ph.D. in math, which he planned to use working for the Department of Defense. Instead, Thomas got sidetracked by a new passion: teaching. He taught math in a few different colleges for his entire career, spending thirty-seven years in education before retiring with a net worth of $2.6 million.

Did Thomas come up with a new mathematical breakthrough that revolutionized education? Did he use his math skills to make a killing in Vegas? No. Thomas made his millions slowly and steadily, working in a job he loved and designing a life that allowed him to build wealth on his own terms. What was his secret? He says he stayed away from debt, paid for everything he bought with cash, worked extra hours, and made wise investments. Sophisticated stuff, huh?

I know what you’re thinking: Hogan, this guy built his wealth decades ago, when the economy was better and the cost of living was lower. You know what I call that? An excuse.

But just to show you that his story isn’t an exception, let me tell you about another everyday millionaire:

Larry came from humble beginnings. His parents were Wisconsin dairy farmers who had never gone past the eighth grade. They were hard workers who hated debt—and who taught their children to hate debt, too.

Becoming the first person in his family to graduate college, Larry left the dairy farm and began a thirty-five-year career in insurance. Throughout his working years, Larry kept his spending in check, just like his parents taught him. He avoided all forms of debt except a mortgage.

He and his wife lived well below their means throughout their marriage, making saving a priority from Larry’s first full-time paycheck. Even when he was only making $5,500 a year early in his career, he still prioritized his saving and managed to save $100 a month. When he got a raise, he increased his savings. When he got an annual bonus, he saved it. When his company introduced the 401(k), Larry maxed it out. He never played around with debt, and he never got distracted by risky investments that others tried to push on him. He worked hard, stuck to his plan, drove old paid-for cars, and didn’t pay any attention to what other people had.

The end result? He retired early at age fifty-five and has a current net worth of over $4.2 million. Now, he gets to travel, play golf and tennis several times a week, visit his children and grandkids whenever he wants, and enjoy long walks and bike rides with his wife.

Did you notice the similarities in their stories? They didn’t let their family upbringing stop them. They took control of their finances and determined to live, work and save on their own terms. And both of their stories are, well, ordinary. These millionaires are everyday people—just like you and me.

HOW TO BECOME A MILLIONAIRE ON ANY INCOME

So, how can someone who didn’t grow up wealthy become a millionaire? As the stories showed us, there is a familiar pattern. Here’s a quick outline:

1. GET OUT OF DEBT.

Think of debt as a ball and chain wrapped around your neck, slowly choking you. I know it’s a violent visual, but I want you to understand just how bad debt is. You have to hate it enough to get rid of it. Period.

2. FOLLOW A BUDGET.

The research revealed that millionaires stick to the budgets they create. Did you catch that? Millionaires budget their money! They also use coupons when they shop. In fact, our research found that 93% of net worth millionaires use coupons all or some of the time when shopping. Those are my kind of people!

3. INVEST CONSISTENTLY.

The millionaires we interviewed said their company’s retirement plan was the number one contributor to achieving high net worth. As their income increased, so did their monthly contributions to their retirement plan. They invested money month after month, year after year.

4. STAY FOCUSED—FOR A LONG TIME.

Here’s the bottom line: becoming a millionaire is a marathon, not a sprint. On average, our survey participants hit the million-dollar mark at age 49. If they started working right out of college, they kept saving, budgeting, and working toward their financial goals for almost three decades. Staying focused for that long takes discipline.

I know these steps aren’t flashy. They won’t grab headlines. But they work. I know thousands of people (about 10,000 of them!) who will tell you it worked for them. The process will work for you, too.

Are you in? Let’s do this!

If you want to learn more about building wealth, check out my new book, Everyday Millionaire: How Ordinary People Built Extraordinary Wealth—and How You Can Too. You’ll find lots of other stories about people just like you who hit the million-dollar mark. You’ll also learn about other myths that are keeping you from reaching that goal yourself. So, get your copy today!

Written by Chris Hogan from ChrisHogan360.com

As we are seeing daily, construction is booming in Las Vegas. This has led to an increase in property values and taxes, and for some tenants, an increase in rental prices. This article addresses rent increases in dwellings under Chapter 118A and manufactured home parks under Chapter 118B of the Nevada Revised Statutes.

In dwellings under Chapter 118A, a landlord must give the tenant 45 days written notice of the intended increase prior to the first rental payment being due. If there is a written lease agreement with a specified rent amount, the landlord is not permitted to increase the rent during the term of the lease. However, if the lease provides for a rent increase at the end of the term or if the landlord gives written notice to the tenant 45 days before the lease is due to expire, the new rate will apply at the expiration of the term, provided the tenant continues to occupy the premises. In a periodic tenancy with a term of less than one month, the landlord is only required to give 15 days’ written notice (NRS 118A.300).

In addition to the requirements of the above, a landlord may not increase rent in retaliation against a tenant (NRS 118A.510(1)). For example, if a tenant complains of a health code violation, joins a tenant’s union, or terminates their rental agreement as a result of domestic violence, the landlord may not increase the rent in retaliation. There is a similar to statute relating to retaliatory conduct by a landlord under Chapter 118B. For a complete list of the prohibited retaliatory conduct, refer to NRS 118B.210.

Currently, Nevada does not have any “rent control” laws and landlords may increase the rent to any amount which the market will bear.

For space rentals in manufactured home parks under Chapter 118B, a landlord must give written notice to the tenant 90 days prior to the first increased payment (NRS 118B.150(1)(a)(3)). The notice must be given to the tenant either by personal service or by first-class mail (NRS 118B.030). Any rent increase must result in the same rent charged for manufactured homes of the same size or lots of the same size or of a similar location within the park (NRS 118B.150(1)(a)(1)). Landlords under Chapter 118B should also be aware that when a service, utility or amenity is decreased or eliminated, the rent must be reduced proportionately (NRS 118B.153). For instance, if a manufactured home park offers landscaping services included in the monthly rent, and later decides to eliminate this service, the rent must be reduced proportionately.

If you have questions about rent increases, required notices, or retaliatory conduct, contact an attorney.

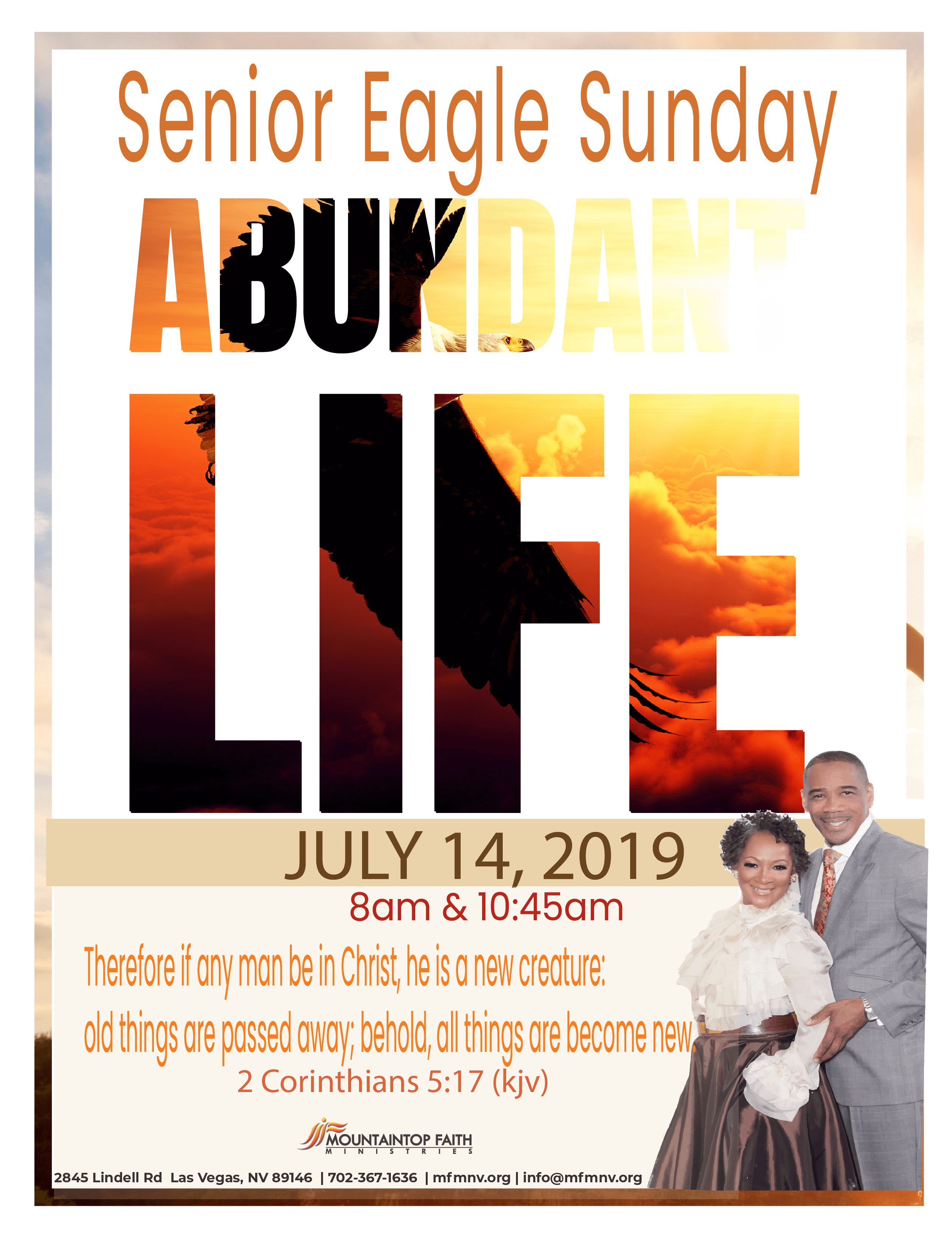

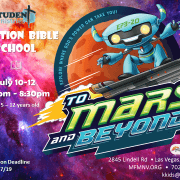

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

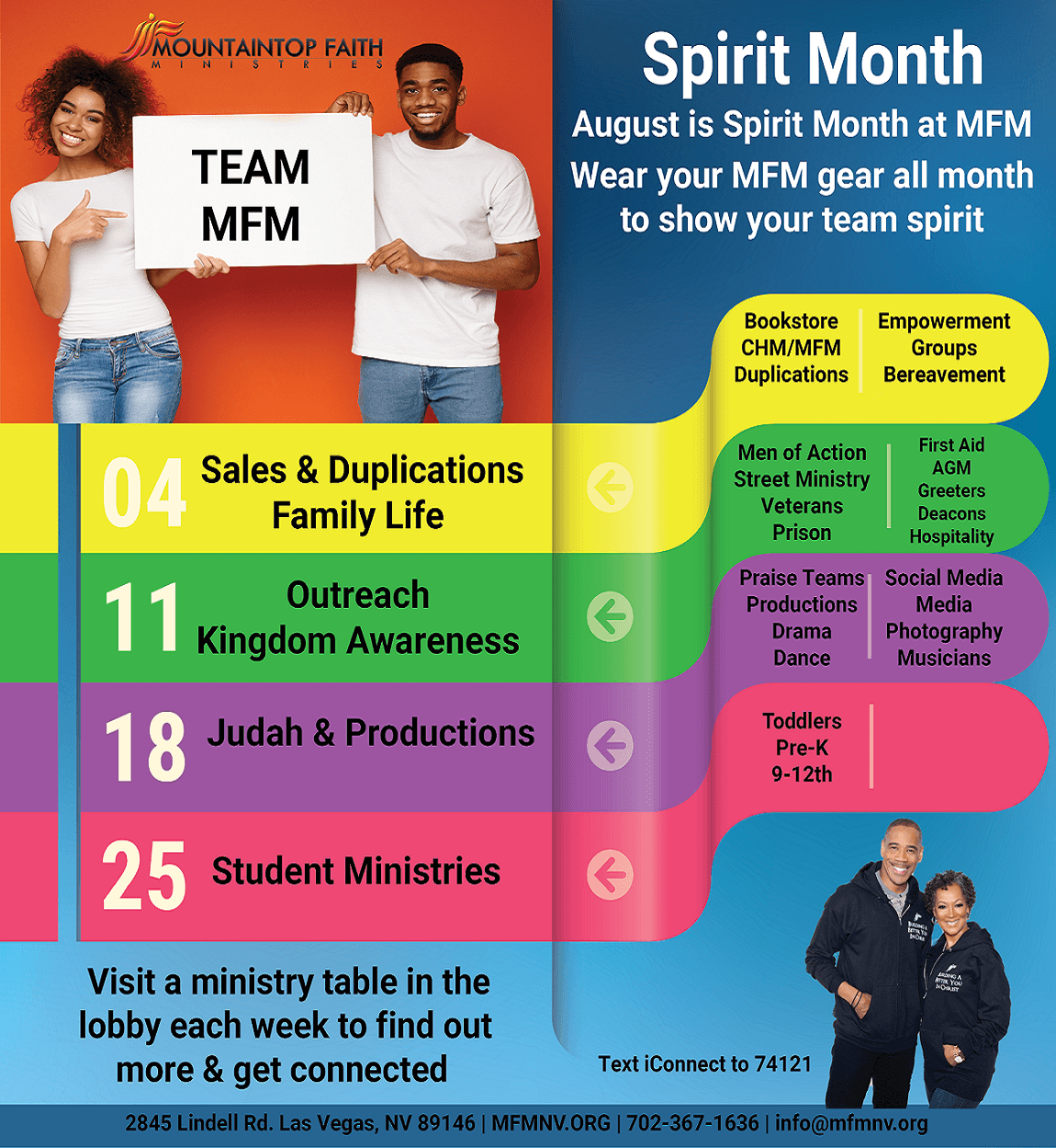

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton HouseConcluded for 2024 Check schedule for special services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2024 Check schedule for special services