#Giving Tuesday is a global day of giving that is designed to encourage individuals, communities and organizations to celebrate generosity worldwide.

On May 5, 2020, people all around the world are coming together to tap into the power of human connection and strengthen communities at the grassroots level. Will you be one of them?

We will be one of those participating organizations and we need your help!

By joining the #GivingTuesdayNow movement, you’re proving that in times of uncertainty, generosity can bring the whole world together.

Mountaintop provides food and supplies for local and foreign missions.

We volunteer monthly at the Las Vegas Rescue Mission, work with our community partners like Olive Crest, ShadeTree and Roundy Elementary providing food, coats, toys, school supplies, toiletries and more.

Currently our priority is making sure our seniors have the necessities they need; from food and toiletries to protectant supplies.

We want to continue to give people a sense of peace and comfort during this pandemic by spreading the gospel and touching as many people as we can globally via social media and web outlets.

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

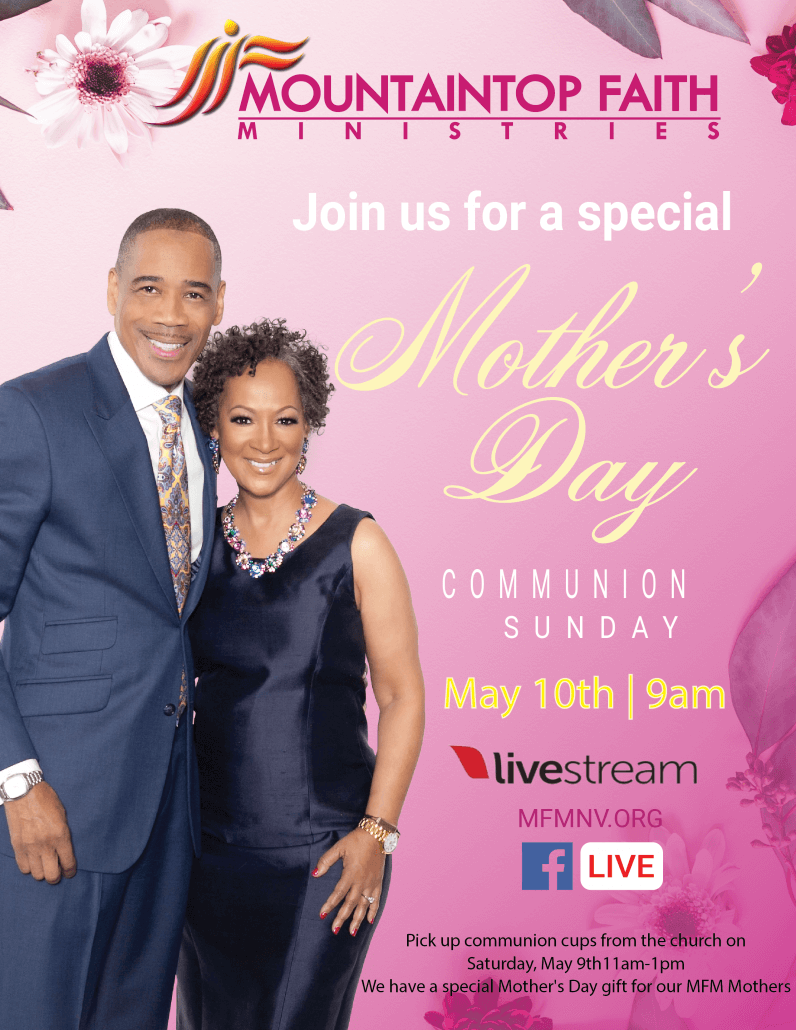

SUNDAYS

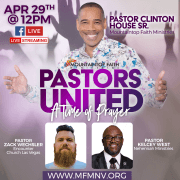

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

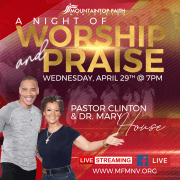

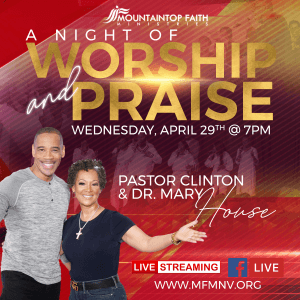

WEDNESDAYS

Bible Study with Pastor Clinton HouseCheck schedule for services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2025 Check schedule for special services