Psalm 80:18-19 Living Bible (TLB)

18 and we will never forsake you again. Revive us to trust in you. Turn us again to yourself, O God of the armies of heaven. Look down on us, your face aglow with joy and love—only then shall we be saved.

I don’t know about each of you, but I feel like something is brewing in the atmosphere that is larger than you and I could ever comprehend in the realm of the spirit. I know that God has been repositioning our lives for a great outpour of His presence and I believe that it is going to take place in our homes, in our personal lives, in our relationships, in our businesses, and in our churches. I can only describe it as the “Spirit of Revival” but not as we have known it traditionally! God is reviving and restoring us. It will cause such a shower of miracles in our worship environment that will blow us away. I think we need to get ready for the supernatural move of God. I mean the type of Revival when Heaven comes closer to earth. It is when the Glory of God again becomes visible in the lives of men, women, families, churches, and the community.

The greatest attraction of Heaven is not the streets of gold. It is not the tree of life. It is not the angels and the fellowship with others of the faith. It is the constant Presence and Glory of our Lord. Revival is when we taste something of this constant Presence of God on earth and in our everyday lives. The word revival has a variety of meanings for Christians today. For some, it simply means a series of meetings. Some think of revival as a time when people place their faith in Christ and receive Him as Savior and Lord. Other people have used the term revival to describe a spiritual awakening during which large numbers of people are converted. The real meaning of revival in the Bible is when God’s people realize their need to be spiritually restored and revitalized in their walk with Jesus. It starts at home and then spreads to our churches, communities, cities, and our nation.

The word, revive is made up of two parts: re, meaning “again,” and vive, meaning, “to live.” Thus, revive means “to live again, to come or be brought back to life, health, or vitality.” Revival is a time when spiritual life and vitality are restored (in the heart and lives of Christian people and the Church). We are embarking upon the 8th month of the year, not only is this the month of new beginnings but it is also the month of “Restarting” the month of Regeneration, the number of Covenant, Rebooting, and finding God.

Revival is a return to spiritual health after a period of spiritual decline into sin and broken fellowship with God. Personal ‘Revival’ occurs when an individual is restored from a broken fellowship with God. ‘Revival’ in the home occurs when family members are restored from a broken fellowship with God, and the Lord Jesus is once again the Head of the home. ‘Revival’ in the local Church, community and nation is a sovereign act of God and occurs when God restores the spiritual health and vitality of His people on a much bigger scale. It is then that you will see the Spiritual hunger restored in the hearts of the people. My prayer is that this month you will begin to pray and ask God to send the Spirit of Revival to our souls, families, communities and to our churches. Get ready for the “Fire of Revival!”

Pastor House

I’ve done my share of stupid things.

That’s one of the reasons I’m so passionate about helping people. I want them to avoid mistakes and poor decisions that could trip them up as they build wealth for the future. And let’s be honest—there are a lot of ways you can set yourself back five or 10 years with one minute of stupid.

So, let me share a story of one major mistake I made and how you can learn from it. Hopefully, it will serve as a lesson to stay laser-focused on your long-term wealth-building plan.

MY MILLION-DOLLAR MISTAKE

I was newly married. My wife and I were both working and making good money. I decided to risk $2,500 to dabble in some single stocks (bad move, I know) in a company called AOL. Before we knew it, the stock had more than doubled! Of course, our success got to our heads, so we bought more stock—to the tune of $10,000. In one stock. We thought we were winning, so we kept adding one dumb mistake onto another.

That $10,000 grew to $25,000. That was a huge amount for a newly married, young couple. We thought we were sitting on a proverbial gold mine! Even though that money was in a single stock, it was a large piece of our financial picture. Talk about unbalanced!

Rather than get some direction from a financial advisor, I thought I knew enough to manage my investment. I firmly believed that if my stock had grown that much already, it had the potential to go through the roof! What could go wrong?

A lot. A lot could go wrong. Before long, there was a small correction in the market, and my stock took a hit. Rather than cut my losses and run, I decided to double down. (Another bad move, I know.) I doubled my losses instead. In the end, I lost about $25,000 before I got out.

I did the math. If I had invested that $25,000 in a mutual fund with a 10–12% return, that money could have grown to $168,000 in 20 years. If that’s not painful enough, that same $25,000 could have meant $1.1 million by the time I retire.

Listening to my buddy and investing in a single stock cost me $1.1 million.

Even now, that stings a little.

WHAT YOU CAN LEARN FROM MY MISTAKE

The only thing that eases the pain of that loss is knowing that other people can learn from my mistake and avoid rash decisions that could cost them—literally. Here are a few things you can take away from my time in Stupid Land:

- DON’T INVEST IN SINGLE STOCKS.

I can’t emphasize this enough. You’re just asking for trouble. I know you hear news stories of people who invested early in some previously unknown tech company that’s now worth billions. And you think, Why not me?

Listen up, people: The chances of that happening to you are astronomical. Like finding a needle in a field full of haystacks. Basing a large part of your financial future on those odds is stupid. Plain and simple. I can’t be any clearer than that.

- DON’T FALL FOR A GET-RICH-QUICK PLAN.

My buddy convinced me that this was the deal of all deals. He said there was “no way I could lose,” and the early strong returns convinced me he was right. I fell for the myth of quick wealth. It lulled me into a false sense of security, and it took huge losses to shake me out of that slumber. I got impatient and greedy. And I paid the price.

If these overnight success opportunities worked, you’d hear about them every day! But you don’t hear about them—because they don’t work. There’s no such thing as a “sure thing.” Building wealth is a slow process. It takes time and stubborn persistence to stick to a proven plan—balanced investing in mutual funds. It’s not flashy. It won’t make headlines. But it works—if you stick to it and don’t get sidetracked.

- DON’T GIVE UP WHEN YOU MAKE MISTAKES.

When I was looking at an empty bank account after the AOL stock plummeted, I had two choices: I could wallow in self-loathing and regret, or I could pick myself up, learn from the experience, and get back on track. You have the same choices.

Notice that I said when—not if—you make mistakes? That’s because you will make mistakes. Hopefully, they’ll be minor ones. But when those happen, you can stay where you are—or you can move forward. And I guarantee that you won’t ever build wealth by reliving your past mistakes.

- GET ADVICE FROM THE EXPERTS.

One of the reasons I lost so much money is because I didn’t get the help of people who knew more about investing than I did. I thought I could handle it. My young pride didn’t think I needed help. If I had talked to someone—and if I had listened to their wisdom—I might be $1.1 million richer in retirement.

I can’t dwell on my past, but I can choose differently in the future. That’s why I meet with a financial advisor regularly. These people know to invest inside and out. That’s the world they live in. An advisor can keep you away from risky decisions and steer you in the direction of wiser ones (if you’re willing to listen). They can rebalance your portfolio, suggest changes in your investments, and explain tax implications you might face.

Everyone makes mistakes, but some mistakes can be avoided. No matter how much you have in the bank, you need to stay focused. Keep your eye on your goals. Don’t let anyone or anything distract you from your financial goals. Your future is too important to lose sight of the finish line.

If you want to learn from others who have built wealth the right way, get my book, Everyday Millionaires: How Ordinary People Built Extraordinary Wealth—And How You Can Too. We surveyed over 10,000 millionaires to discover the habits and practices that helped them hit seven figures in net worth. Their answers might surprise you!

Written by Chris Hogan from Chrishogan360.com

Homeowners have a love/hate relationship with their Homeowner Associations (HOAs). You rarely hear someone say, “I love my HOA Board.” The purpose of an HOA is to preserve, maintain and enhance the homes and property within the subdivision. Sounds wonderful, doesn’t it? But not all HOAs are equal. An HOA that regulates that neighbor with a weed-ridden front yard or a broken-down Chevy in the driveway is a blessing. However, when that same HOA tells us that when and where we can put our trash cans out, we aren’t appreciative. I am not a fan of someone telling me what I can do with my property and land. But I do understand the utility of an HOA Board.

Community living comes with its own dynamics. Close quarters and shared spaces can—and often does—lead to conflict: a conflict between neighbors, the association board of directors, and members; and also between the board or members and management. Unlike other locales, Nevada requires that members of common interest communities go to the Office of the Ombudsman of the Nevada Real Estate Division for conflict resolution before filing a lawsuit.

Before any civil action can be taken regarding a dispute relating to governing documents of a common-interest community (homeowners association), the disputing parties must complete the Alternative Dispute Resolution (ADR) process under Nevada Revised Statutes (NRS) 38. Further, if a homeowner association provides a scheme of dispute resolution, that procedure must be exhausted before submitting an ADR claim to the Nevada Real Estate Division, Office of the Ombudsman.

The ADR programs include:

• The Referee Program

• Mediation

• Arbitration

- The Referee Program – The referee program allows disputing parties to present their case to an independent referee. Both parties must agree to participate in the program to proceed. The referee can bring the parties together, listen to both sides of the dispute, review the evidence and governing documents and then make a non-binding decision on the matter. The referee is authorized to make monetary awards of up to $7,500. The referee may not award attorneys’ fees. The parties may then proceed to civil court if they wish to pursue the matter further.

- Mediation – As of October 1, 2013, NRS 38 mandates that mediation is the default method of resolution, should both parties not agree to participate in the referee program. The parties to the mediation provide the mediator a statement and relevant documents about the dispute, including a statement concerning an acceptable resolution. The mediator works with the parties to resolve the dispute with a written agreement.

- Non-Binding or Binding Arbitration –This option is available if mediation fails and both parties agree to proceed through either form of arbitration in place of initiating a claim through civil court. Each of the parties has an opportunity to present his or her case and witnesses if any. The arbitrator upon conclusion of the hearing renders a decision, after which either party may proceed to civil court.

For more information, please contact the Nevada Real Estate Division, Las Vegas,

realest@red.nv.gov, P: (702) 486-4033.

Tanika M. Capers, Esq.

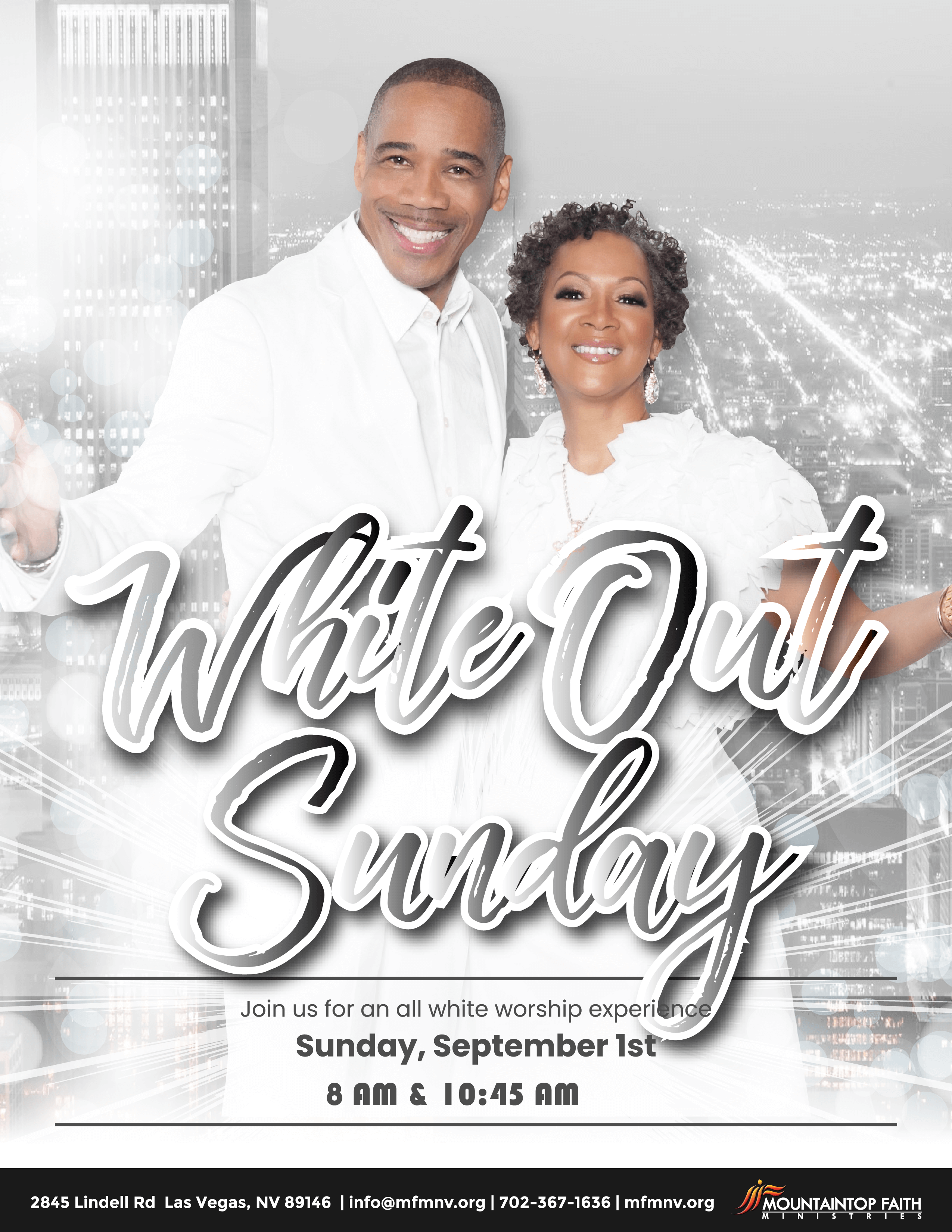

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

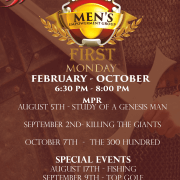

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton HouseCheck schedule for services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2025 Check schedule for special services