It’s been almost a year since the Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the American tax system. Sitting down to do your taxes in the next few weeks – or talking with your tax preparer – will involve tackling the most sweeping changes in the federal income tax rules in more than 30 years. Let’s look at some of the changes.

–All individual taxpayers will now use the same 1040 simple form. It replaces the old 1040, the 1040A and the 1040EZ. You may need to file supplemental schedules with your 1040 in certain cases, such as if you itemize deductions or qualify for a variety of tax credits other than the basic child tax credit.

Should you Itemize this Year?

“You still want to run your numbers both ways,” said Jackie Perlman, tax research analyst at H&R Block’s Tax Institute, meaning you should try itemizing and comparing the outcome with just taking the standard deduction.

Families who own a home, in particular, will want to review whether they’d still itemize to lower their tax bill. You’d need deductions to exceed the new higher, standard deduction, which is nearly double from a year ago. And you’ll face new limits relating to the deduction you can take on property and income taxes.

Married couples filing jointly are looking at a standard deduction of $24,000 on their 2018 federal income tax returns — $11,300 up from the old amount of $12,700 on the 2017 tax returns.

Single filers are looking at a standard deduction of $12,000 — up by $5,650 from the old amount of $6,350 on 2017 returns.

But there also is an additional standard deduction for those who are 65 or older, or blind.

If married filing jointly, and you or your spouse are 65 or older, you may increase your standard deduction by $1,300. If both of you are 65 or older, the additional standard deduction goes up to $2,600.

If you file under single or head of household and are 65 or older, you may increase your standard deduction by $1,600.

Child Tax Credit

Most parents across the country with young children or teens will be able to tap into the child tax credit on their 2018 federal income tax returns – even if they couldn’t use that credit in the past.

To claim the credit, the child must be 16 years old or younger, as of Dec. 31, and claimed as a dependent on your tax return. The child also must have a valid Social Security number.

The maximum credit has gone up to $2,000 from $1,000.

Another plus: Now, up to $1,400 per child is available as a refundable credit. Families can claim the credit if they earn the income of $2,500 or more in income. As a result, some families can get refunds even if their taxes are $0

Exemptions

In the past, taxpayers could take an exemption deduction for themselves, spouse and each of their dependents. Each personal exemption reduced gross income by $4,050 on 2017 returns. A new credit, often called the Credit for Other Dependents, offers $500 for each qualifying child or other dependent relatives, such as older relatives in your household, if they do not qualify for the child tax credit. Now exemptions have been eliminated.

What Else Has Been Eliminated?

Business Expenses: If you have unreimbursed business expenses from last year, you won’t be able to deduct those anymore. Depending on your job, this could be a big loss. This can include travel expenses from business travel your employer didn’t pay for, scrubs or uniforms you paid out-of-pocket; or continuing education classes you took for your profession.

Job search expenses: You can no longer deduct for expenses related to finding a new job. Before those expenses could include travel costs incurred for a job interview, fees for resume and cover letter services, or fees for job-placement services. “Even if you didn’t get the job,” said Lisa Greene-Lewis, a certified public accountant and tax expert at TurboTax.

Tax preparation fees: You can’t write off any costs from getting help with your taxes from 2018 through 2025 under the new tax law changes. There’s one exclusion: Self-employed workers can still deduct these services as a business expense.

Charitable contributions: Since the standard deduction claimed by individuals or couples has nearly doubled, fewer people will itemize and you must itemize in order to deduct charitable donations from your taxes.

I used to think I would be better off without margins. I see things a little differently now. Margins are a good thing. Yes, they are restricting, but they are meant to be. Margins provide structure, and structures introduce order where there is chaos. The structure margins create to bring a sense of “alignment” that is badly needed but is missing. Think about someone you know whose finances are a wreck. I would be willing to bet (and I live in Vegas) that they spend without margins or their margins are a way to close to the edges. I know, everybody thinks more money would fix their money problems, but, although popular, more often than not, it just isn’t true. Everybody wants more money, but what are they doing with the money they already have?

Financial margins are a must if you plan to be successful with money. How else will you know who much you spend on the essentials? How will you know who much you can save? How will you know how much you can afford to invest? How can you ever expect to be consistent with anything if you don’t have defined boundaries? You need a plan. A plan that is built on systems and defined by structures or margins. And these margins are created in a budget. That’s right, the dreaded “B” word rears its ugly head again. I get it, just the word “budget” is draining and brings up thoughts of mind-numbing pointless boredom. While I admit, it can be that way, it doesn’t have to be. Budgeting allows you to see, on paper, where your money is going. They allow you to tangibly see what you are actually doing with your money on paper. Now, you might not like what you see, but sometimes the truth is ugly. But you still need to see it. There is a simple test you can perform to give you an idea of how well you are doing handle money. Ask yourself, some simple questions. How much money do you spend on food? How much do you spend on bills? How much do you spend on paying off debt? Now, you may be able to answer those questions easily, but here come two or three questions that most people with money issues cannot answer. Ask yourself, where is all this written down? Can you account for all the money you earn? Is there any money that is wasted or unaccounted for? At your current rate, what is the exact date you will be debt-free? Uh-oh. I heard a hush come over the readers. Those are the tough questions to answer because an honest answer demands a different level of stewardship and greater attention to detail. But those are the questions you need to be able to answer if you want to win. A written budget gives you a picture, albeit in numbers, to answer these tough questions.

A life lived without margins is surprisingly unfruitful and often ends in tragedy. The same is so with our finances. Our spending habits need structure, and this structure actually turns out to be more enabling than restrictive. A structured plan, or budget, helps bring clarity to a financial situation. And with clarity, financial progress can be made. Haven’t you compassed this mountain long enough? (A reference to Deut. 2:3 for you bible scholars). It’s time to move forward. It’s time to take your dreams and turn them into goals (goals are nothing more than dreams with a deadline). It can be done, but it will take introducing a different level of order and discipline to your finances. We serve a God of order (1 Cor. 14:33), and he expects us to do everything decently in order (1 Cor. 14:40). Shouldn’t this apply to our finances too? It’s time. It’s time to make financial progress. It’s time to break down and do the uncomfortable things we dread to get the results we want. Are you willing to make that sacrifice? Are you willing to do it God’s way? God Bless.

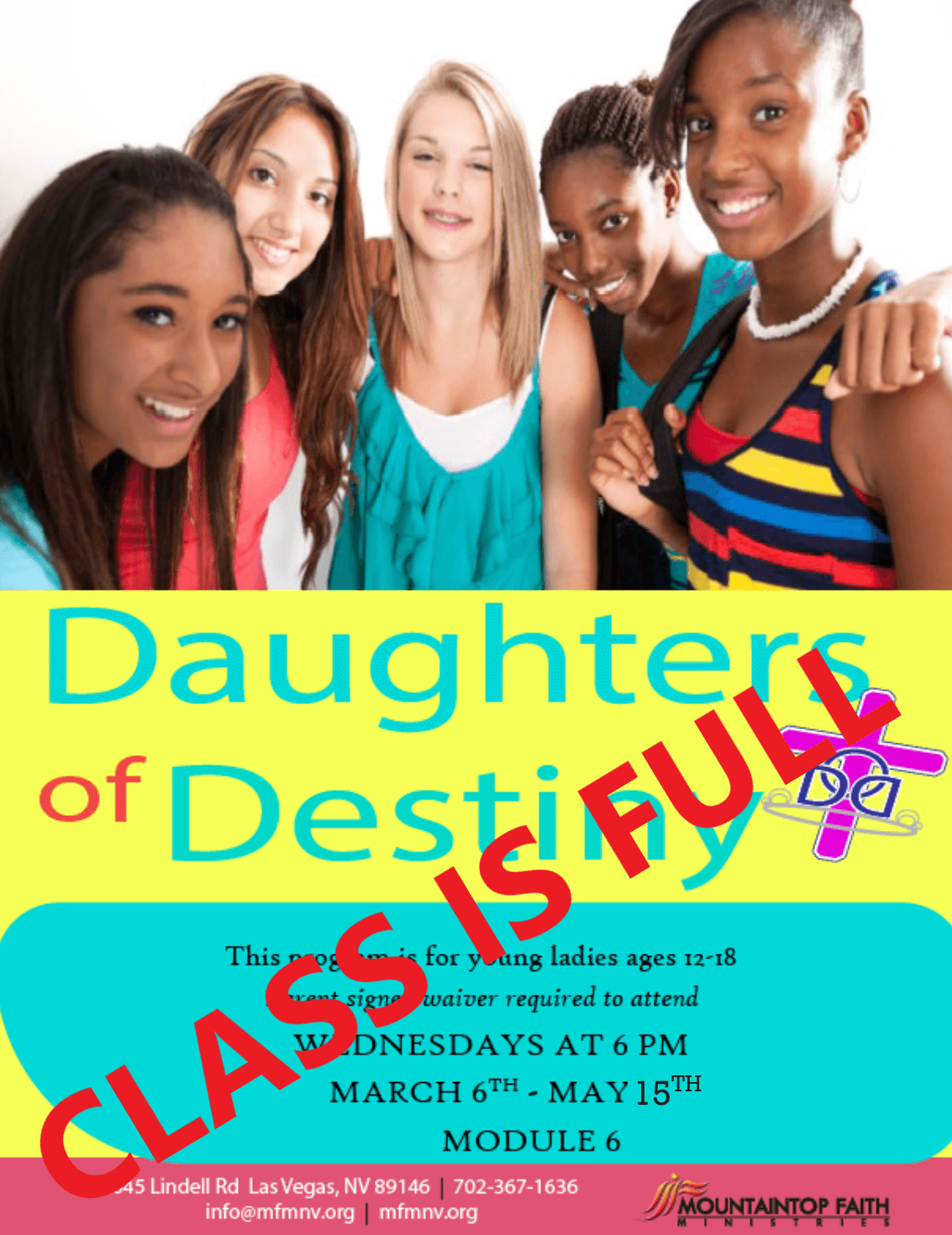

Daughters of Destiny

/in Past Events/by SupportadminSPRING CLASS IS FULL; STAY TUNED FOR FALL CLASSES

PARENTS COMPLETE THIS FORM ON BEHALF OF YOUR DAUGHTER. IF YOUR DAUGHTER IS NOT LISTED UNDER YOUR HOUSEHOLD, PLEASE CONTACT THE CHURCH DATA OFFICE 702-367-1636.

https://mfm.infellowship.com/Forms/415325

This is a young women’s (12 years old to 18 years old) small group that has service on Wednesdays in Module 6. The staff of D.O.D are role models for the youth maintaining a godly character. D.O.D provides spiritual and creative curriculum to keep youth excited and involved in REAL discussions about our Christian walk.

*Must have signed waiver to attend*

Through the teachings of “Every Young Woman’s Battle”, we will discuss sexual purity from emotional, mental, spiritual, and physical perspectives, teaching our young ladies to guard their minds, hearts, and bodies in this sex-saturated world. Our goal is to present a credible, helpful, Christian perspective on the images our ladies are exposed to every day.

The spring session will run for 10 weeks starting March 6th at 6pm until May 15th. We will not meet during the week of spring break (April 17th)

If you have any questions, please email Minister Candace House (candace@mfmnv.org) or Sister Patrice Burnett (pburnett@mfmnv.org).

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton HouseCheck schedule for services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2025 Check schedule for special services