Christian views on alcohol are varied. But what is clear is that driving under the influence (DUI) or driving while intoxicated (DWI) are serious offenses. DUI/DWI are offenses committed when a driver operates a vehicle after the consumption of alcohol or drugs or other intoxicants. I oftentimes hear people say “I only had one drink at dinner and I am fine to drive.” It’s important to count the cost of even consuming a small amount of alcohol and driving.

REGULATIONS FOR DUI/DWI in NEVADA

In Nevada, the Blood Alcohol Content (BAC) limit is set at 0.08% for drivers over 21 years of age and it is set between 0.02 and 0.08% for those under 21. For commercial drivers, the limit is set at 0.04%. Despite these guidelines, a driver may be arrested and be convicted for a lower BAC.

Having a Nevada license automatically provides your consent to be tested if stopped by a law enforcement officer, while driving. This is the law of “implied consent” and can be used by the officer to test you if you are stopped on the suspicion of drunk driving, either through a breathalyzer test or by an actual blood test to check the BAC. Refusing to take the chemical test will result in your permit to drive or license being seized; you may be arrested and taken for testing.

Points will be added to your driving record and your license will be suspended or revoked if you are convicted of DUI/DWI. The number of points assessed, depending on the severity of the offense and the number of times you have been convicted for it.

ACTIONS AGAINST DUI/DWI FOR DRIVERS OVER 21:

If you are over 21 years old and are caught with BAC higher than the set limit of 0.08%, you may be subjected to criminal actions in addition to administrative actions. If the DUI/DWI incident you are involved in is subjected to the criminal action, it is recommended that you get in touch with a DUI/DWI lawyer as they are experts at handling such incidents and can offer you the best advice.

The first drinking and driving offense is normally treated as a Misdemeanor and may result in imprisonment for between two days and six months (or community service for 96 hours) and/or a $400- $1000 fine. Also, if convicted for a first offense:

o Your license will be revoked for 90 days;

o You may be eligible to drive using the restricted license for 10 hours a day for six days each week, with an Ignition Interlock Device after 45 days of revocation;

o You may have to pay $150.00 that is the average cost of DUI School; and

o You may have to undergo a treatment program if BAC is 0.08 or above.

ADMINISTRATIVE ACTIONS AGAINST DUI/DWI:

Nevada laws have administrative implications in addition to the criminal laws against DUI/DWI. An officer may arrest a driver if:

• He/she is aged 21 and above and is driving with BAC 0.08% or more.

• He/she is aged below 21 and is driving with BAC 0.02% or more.

If you are arrested for DUI/DWI, the arresting officer will confiscate your Nevada driver license and issue a temporary seven-day driving permit, complete a notice of license suspension/revocation based on the nature of the offense along with a warrant, if applicable; and send the entire set to the Department of Motor Vehicles.

The driver can schedule an administrative hearing after the notice of suspension/revocation. It is a good idea to consult a DUI/DWI lawyer beforehand. If the hearing goes against the driver, his/her license will be suspended or revoked based on a previous seven-year driving record. If there are any alcohol related convictions or suspensions for this seven-year period, the license will be revoked for one year, and if not, then it will be suspended for 90 days. You may be eligible to drive using the Restricted License if you meet the conditions. The suspension or revocation begins five days after the final order of the hearing officer is mailed from the Department of Motor Vehicles. If the administrative hearing goes against the driver, one can ask for a review from the circuit court. If the driver, however, does not request a hearing, then the suspension/revocation begins after the arrest and is final.

LICENSE REINSTATEMENT AFTER DUI/DWI SUSPENSION/REVOCATION:

If you are convicted of DUI/DWI, it will result in your license being suspended or revoked. This means that your driving privileges will be taken away and you will need to apply for a reinstatement of your license with the Department of Motor Vehicles, once the period of suspension or revocation is over. Reinstating a license after a suspension of a year, or revocation will also mean taking the driving tests all over again. These will include the vision test, knowledge test, and the road test. If you do not complete the reinstatement requirements, the license will remain suspended or revoked.

1. To complete the reinstatement requirements, you must prove that you have successfully completed the DUI school program or a comparable program, pay the reinstatement fee of $65, pay Victim’s fee of $35.00 and maintain proof of financial responsibility for three years from the date of suspension/revocation by filing SR-22, if you are over 21 years old. SR-22 may also be required for those aged below 21.

2. If you are being convicted, the court may order an ignition interlock device to be placed for breathalyzer tests on any vehicle you drive at your cost.

3. You can submit the reinstatement application and fees in person at a Department of Motor Vehicles office near you.

So remember to ask yourself…is it ever wise to drink and drive?

Recently I had a revelation about myself; I am terrible at keeping in contact with people and checking in on them, I am terrible at maintaining relationships. One of my best friends, Londyn, wrote me a letter that opened my eyes to this revelation. In this letter, she detailed a timeline of our friendship, recalling the times I had stopped returning her calls, checking in on her and spending time with her altogether. She explained to me that she felt that our relationship had died because of my lack attention to it. I am currently in the process of learning that our personal life often mirrors our spiritual one. This letter caused me to reexamine not only my relationship with Londyn but my relationship with God. I realized I was neglecting my platonic relationships, as well as neglecting my spiritual walk.

When I examined my life, I realized that I fell out of a relationship with God because I stopped talking to him. Any relationship that you don’t water with attention, will eventually wither up and die; so was the truth for neglecting my private time with God. Recently I made the commitment to pray more and it has made all the difference in my spiritual journey. Prayer is the thing that fortifies and anchors me in God. It’s that thing that truly brings me out of whatever I am experiencing in life and allows me to enter his presence; focusing my mind on God and his promises, not the challenges.

How to pray.

Initially, my prayers started with me acting like Jesus was in the passenger seat of my car. I would talk to him about everything from how my day went, to my deepest problems. I carried that mentality where ever I went; I made a habit of talking to Jesus. I wanted him to be more real to me than the people I spoke to every day. Eventually, I started to carve out specific times of the day to center my mind and focus on God. Now it has evolved into the time where I clear my mind and my heart and not only speak to God but listen. It is in my prayer time that I hear the hopes and dream that God has for me. Praying often and consistently has allowed God to download his purpose for my life into me. In 2 Chronicles 7:14 it states, “ if my people, who are called by my name, will humble themselves and pray and seek my face and turn from their wicked ways, then I will hear from heaven, and I will forgive their sin and will heal their land.” Prayer is the time where we humble ourselves, seek the face of God, then watch him forgive and heal us. In Prayer, is Power.

Bible verses that have encouraged me to Pray.

Mark 11:24

Matthew 26:41

Romans 12:12

Matthew 6:9-13

Luke 18:1

Romans 8:26

Philippians 4:6

Colossians 4:2

Treaha Weatherspoon

Very few people save their way to becoming wealthy. Instead, people who have gained a measurable amount of wealth tend to invest their money into appreciating assets that, over time, are worth more. Appreciating assets such as real estate, stocks, mutual funds, bonds, CDs (certificate of deposits), annuities, and a whole host of other opportunities are purchased with the expectation that their value will grow and increase the buying power of the money invested. With so many different options, it can be quite overwhelming when attempting to grasp all the information available for each investment opportunity to know which is right for you. So how do you know what a “good” investment is?

Any investing advisor worth their salt would advise any investor to consider a few factors such as the risk, volatility, liquidity, and history of the investment to evaluate the quality of an opportunity. But, of all the metrics used, one of the most popular is the interest rate or the “return rate” of the investment.

When it comes to investments and their earnings, interest rates can be simply be defined as the rate of increase of the value of an investment. Basically, it’s a measure of how hard your money is working to make more money! The higher the interest rate, the harder the investment is working, and the more money the investment is making. If an investment has a negative interest rate for a period of time, it actually lost value over that period. Inflation is a great example. Inflation can simply be defined as the rate at which money loses value over time. As time passes, money is worthless and it cost more money to buy the same items. Money loses its buying power. I know nobody likes to lose money! But the reality is all investments are subject to inflation and all investments will have times where they have negative returns. It’s just something that happens.

What is a good interest rate for an investment? It depends on your goals. Consider the following information in an example to demonstrate the power of high investment return rates.

• CDs have averaged 3.73% returns in the last 30 years.

• Bonds have averaged 4.3% returns in the last 30 years.

• Stocks have averaged 11.5% returns in the last 30 years.

• Inflation has averaged 2.6% over the last 30 years.

Assume a $10,000 investment in made in either CDs, bonds, or stocks 30 years ago.

• A $10,000 investment in CDs would grow to almost $28,922 today.

• A $10,000 investment in bonds would grow to almost $33,904 today.

• A $10,000 investment in stocks would grow to almost $234,948 today.

All three investments look fantastic, right? Well, maybe until you consider inflation. Remember, inflation devalues money and reduces buying power. Inflation has averaged -2.6% for the last 30 years. Because of inflation, the $10,000 invested has been devalued. So now, 30 years later, it takes more than $21,111 to have the same buying power as the $10,000 had 30 years ago. So, $21,111 has to be subtracted from the investment returns as an adjustment because of inflation.

• The buying power of the investment in CDs is reduced by $21,111 to $7,811.

• The buying power of the investment in bonds is reduced by $21,111 to $12,793.

• The buying power of the investment in stocks is reduced by $21,111 to $213,837.

By investing in CDs and bonds, money was made, but it was not impressive considering it took 30 years. But if we look at stocks that have a higher return, the story is different. Even considering inflation, the buying power has still increased to almost $214,000! Now we are building some wealth! This is more than 27X better than the investment in CDs and more than 16X better than investing in bonds.

The whole point of this Money Matters article is to demonstrate the effect a high-interest rate has on the growth of an investment. But a high-interest rate is not the only factor that should be considered. You should think about risk. Although stocks offer high return rates, they also are at high risk. And, on the other side, CDs offer the very low returns, their return rate is guaranteed. I’m not saying investments that have low returns are “bad” investments, but you do have to curb your expectations. If you are looking to grow wealth, CDs and bonds are probably not going to get you to want to be.

A good investment portfolio will have a mixture of investments, and subsequently, the investments will have different return rates. Regardless of your investment mixture, it’s important to understand where, and how, your money is invested. There is no need to try this by yourself! It’s just not wise. If you want to invest, I highly, highly recommend getting a trained professional to explain your investment options and the consequences of each. The bible says, “Wisdom is found in a multitude of counsel” (Proverbs 11:14, 15:22, 24:6), so get professional help and become the best steward you can be! God bless!

I’ve never met anyone who got sick from clean habits, but I have known a lot of people who have suffered the consequences of not practicing cleanliness. Two of the easiest and most important things you can do to stay healthy is handwashing, and, keeping your hands from away from (touching) your face.

Wash your hands frequently and dry them thoroughly. Keep your hands away from your eyes, nose, and mouth because that is the easiest way to transfer germs and viruses into your system, and get sick.

The Centers for Disease Control (CDC) says, “Clean Hands Save Lives!”

Here is some handwashing information I found on the internet from various websites. It is very useful. I suggest you make a lifetime commitment to proper handwashing.

When and How to Wash Your Hands

Keeping your hands clean is one of the most important steps to avoid getting sick and spreading germs. Many diseases and conditions are spread by not washing hands with soap and clean, running water. If clean, running water is not accessible, use soap and available water. If soap and water are unavailable, use an alcohol-based hand sanitizer that contains at least 60% alcohol to clean hands. Note: Alcohol-based hand sanitizers can quickly reduce the number of germs on hands in some situations, but sanitizers do not eliminate all types of germs and might not remove harmful chemicals. Hand sanitizers are not as effective (as soap and water) when hands are visibly dirty or greasy.

Rinsing your hands before you wash them may get rid of topical germs. After adding soap, lather up the soap by rubbing your hands together. Be sure to get the webs (between your fingers, including the web between your pointer finger and thumb). Continue rubbing for 15 -20 seconds. It is recommended that you wash your hands with a song. Singing your ABC’s, or Row, Row, Row Your Boat, or the Happy Birthday song, two or three times, ensures that you are spending adequate time washing your hands.

How to Use Hand Sanitizers

• Apply the product to the palm of one hand (read the label for the correct amount)

• Rub your hands together

• Rub the product over all surfaces of your hands and fingers until your hands are dry

When should you wash your hands?

• Before, during and after preparing food

• Before eating food

• Before and after caring for someone who is sick

• Before and after treating a cut or wound

• After using the toilet

• After changing diapers or cleaning up a child who has used the toilet

• After blowing your nose, coughing, or sneezing

• After touching an animal, animal feed, or animal waste

• After handling pet food or pet treats

• After touching garbage

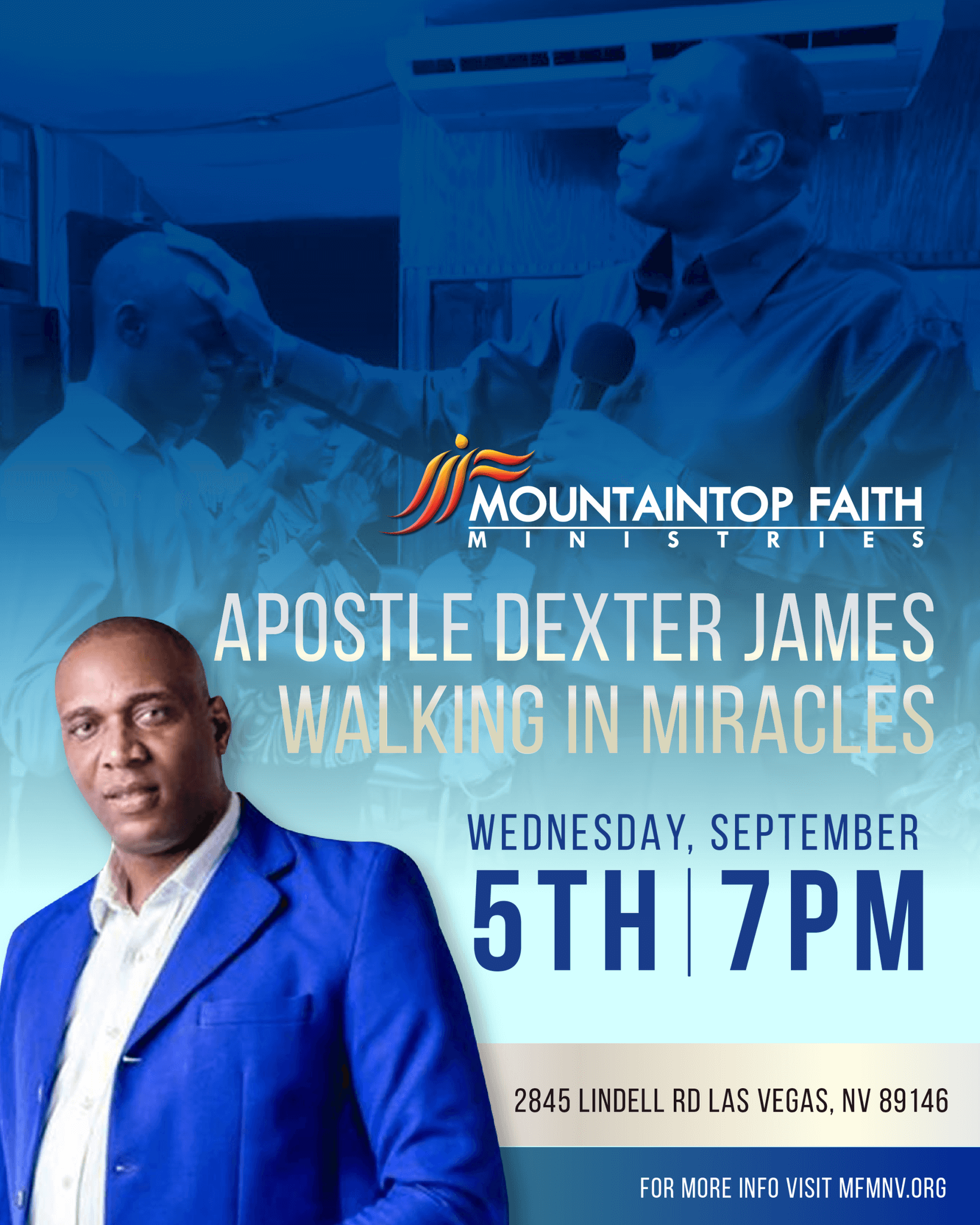

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton HouseCheck schedule for services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2025 Check schedule for special services