Building a healthy family relationship is essential for families of all types. Whether it is a married couple, a family of four or a single mother and her adopted child, families thrive on love. Without a healthy family relationship, it can feel like someone has no one to turn to in times of crisis and or times of celebration. Healthy family relationships do not come automatically–they come with time and effort. The concept of family goes back to the origins of creation. When God created Adam and Eve, he told them, “Be fruitful and multiply” (Genesis 1:28). As a result, the first family came into being, and even though it got off to a rough start, families have been the basic building block of humankind ever since. In an effort to reverse the trend of destructive relationships and strengthen the infrastructure of our society, we must be committed to the education, promotion, and support of each other through prayer, communication, fellowship, resources and most importantly making God and His Word first in our homes. Families play a large part in giving us self-confidence, validation, and self-esteem. Our society considers families the basic unit of the social order: Strong families form the basis of strong communities.

If you are building or rebuilding your family, I pray that these five principles will be a guide for you and your spouse. I am standing in Faith with you, that God will give you and your children the breakthrough that you are praying for, these are simple but applicable steps that can bring positive results in the health of your home.

Family Principle 1, “Eat Dinner Together”

Find the time to eat dinner together as a family. Eating together as a family is a healthy habit that helps to bring everyone together. I believe eating together teaches children proper etiquette and it is an opportunity for open communication. It is a time to bond, be involved and build intimacy. Even if you don’t have children, eating together allows you to relax from the busy pace of work and just talk. It is nothing like hearing the laughter and conversation of family around a dinner table. “How good and pleasant it is when God’s people live together in unity” (Psalm 133:1).

Family Principle 2, “Quality Time”

Spend quality recreational time together doing activities that each of your family members enjoy. Even if your children are adults, take the time to plan family time. You can play board games, attend a concert, go the movies, go see a play, go to a game or read a book together. Creating regular family rituals is vital in showing your family they are important. If you are blending your families invite the all children to be involved; making every attempt to be a peacemaker. Spending regular time together is what makes a family a tight unit. There is a famous quote that states “Your family needs your PRESENCE more than your PRESENTS”. “Therefore if you have any encouragement from being united with Christ, if any comfort from his love, if any common sharing in the Spirit, if any tenderness and compassion, then make my joy complete by being like-minded, having the same love, being one in spirit and of one mind” (Philippians 2:1-2).

Family Principle 3, “Respect”

Respect each other’s personal space. If your spouse asks for some alone time, give it to them. Children learn respect, how they see parents respecting one another. If your children at times need quiet time, teach them to build healthy boundaries. Everyone needs time alone, and respecting privacy is one of the things that build solid relationships. If you have multiple children, it is important to give each one of them, their time alone with you, as the parents. Take your son to a sporting event while your spouse takes your daughter to a movie or nail salon. It is very important that we as parents pray for wisdom in raising our children. God gave each of them different personalities and they will have their own journey in life. Respectfully, we have to give them their space to grow and develop. Alone time with parents helps children feel special, it is their personal time of validation and an opportunity to learn from their first classroom “Home”. “Be devoted to one another in love. Honor one another above yourselves” (Romans 12:10).

Family Principle 4, “Communication”

Allow everyone in the family to openly communicate feelings respectfully. I believe that to maintain a healthy family relationship, each member must be able to communicate freely with one another, as well as listen effectively. Listening allows you to learn more about your family’s thoughts and personalities. Communicating allows you to express yourself to relieve frustrations and other emotions. When your family is having a discussion try never to interrupt a family member through disrespectful tones, demeaning words, or through passive aggressiveness; instead, listen until he/she is finished, then relate how you feel. This effective type of communication prevents and solves arguments, keeping the family relationship healthy. “A gentle answer turns away wrath, but a harsh word stirs up anger. The tongue of the wise adorns knowledge, but the mouth of the fool gushes folly” (Proverbs 15:1-2).

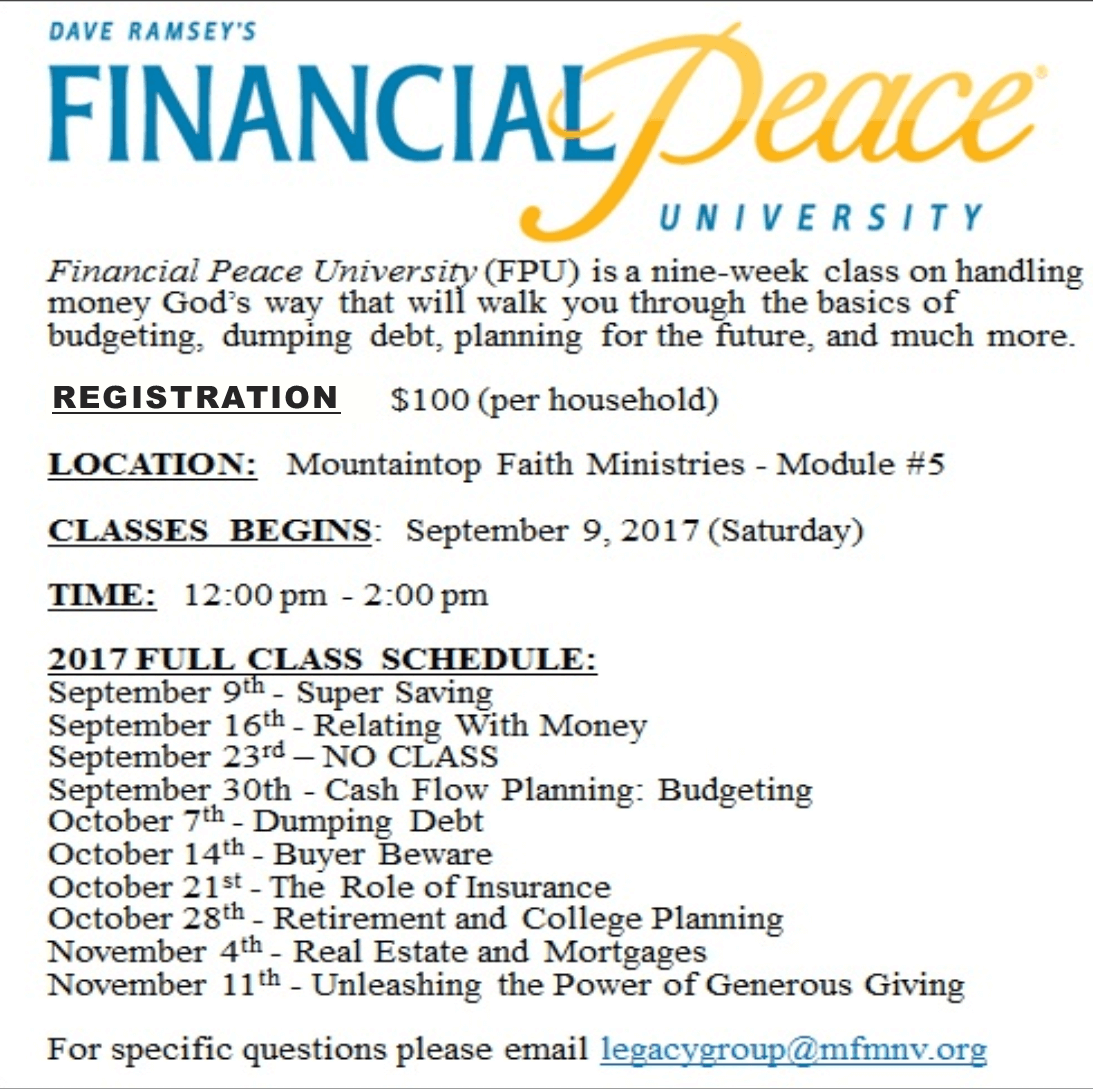

Family Principle 5, “Financial Security”

Many families struggle when comes to financial freedom. Trying to juggle life, responsibilities, priorities, and extra curricular activities can be overwhelming. The key to good money management is expense management. We need to learn to live below our means and be content with what God has given us. This is hard for all of us, but it is a valuable life lesson. Developing a good budget is key. Everything we have comes from God. He owns it, and He entrusts it to us to use for His purposes. True financial success comes not from accumulating a large surplus in our bank account, but from following God’s plan for our finances. As we do this, He will provide for all of our needs. As Christians, our first financial priority, just as in every other area of life, should be God and His work. “And my God will meet all your needs according to the riches of his glory in Christ Jesus” (Philippians 4:19 NIV).

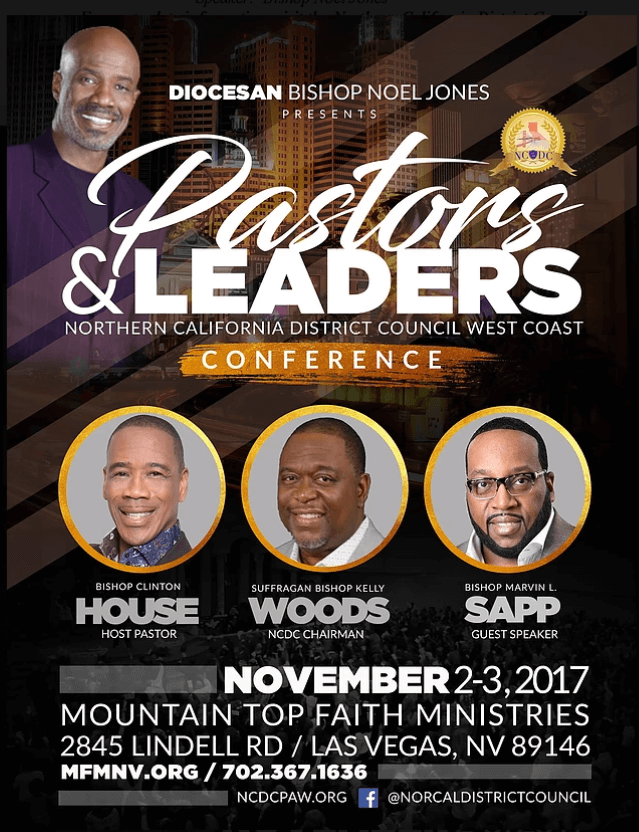

Pastor Clinton House