Nevada has one of the best criminal record sealing laws in the country. After waiting periods are met, most criminal records can be sealed (see waiting periods below). Criminal record sealing in Nevada typically takes about 4 to 6 months. If your record is sealed, it is hidden from public view. For legal purposes, it is as though the events described within the sealed record never occurred and, in most cases, you may say that you were not arrested or convicted of a crime. (Nevada Revised Statutes § 179.285.)

If You Were Not Convicted of a Crime

If you were arrested but the charges against you were dismissed or you were acquitted, you may petition to have the arrest record sealed. (Nevada Revised Statutes § 179.255.)

If You Were Convicted of a Crime:

You have completed probation. After successfully completing court-ordered probation, you may petition to have the related criminal records sealed. (Nevada Revised Statutes § 176A.265.)

You completed a reentry program. If you have completed a program of reentry, you may petition to have the related criminal records sealed. Sex offenses and offenses against children do not qualify. (Nevada Revised Statutes § 179.259.)

Your conviction was set aside. If your criminal conviction was set aside you may, at any time after the set-aside, petition to have the related records sealed. (Nevada Revised Statutes § 179.255.)

You completed a court-ordered drug or alcohol treatment program and your conviction was set aside. After you have successfully completed treatment, if the court sets aside your conviction, the court must also order that the related records be sealed. (Nevada Revised Statutes § 458.330.)

You were convicted of possession of a controlled substance not for purposes of sale. You may petition to have your record sealed after waiting 3 years from the time you were sentenced. (Nevada Revised Statutes § 453.3365.)

You were convicted of one of the crimes listed below. If you were convicted of any of the following crimes in Nevada, you may ask to have your record sealed after waiting the number of years given below.

• Misdemeanors other than gross misdemeanors. You must wait at least 2 years from the date you are released from custody or discharged from probation or parole, whichever happens later.

• Gross misdemeanors. You must wait at least 7 years from the date you are released from custody or discharged from probation or parole, whichever happens later.

• Category E felonies. You must wait at least 7 years from the date you are released from custody or discharged from probation or parole, whichever happens later.

• Category C or D felonies. You must wait at least 12 years from the date you are released from custody or discharged from parole or probation, whichever happens later.

• Category A or B felonies. You must wait at least 15 years from the date you are released from custody or discharged from parole or probation, whichever happens later.

Records for sexual offenses or offenses against children may not be sealed.

How to File

The procedures for sealing your criminal record in Nevada vary from county to county. For more information, contact the court in the county where the arrest occurred. Before you begin, it is a good idea to obtain a copy of your Nevada criminal history record.

Getting Legal Help

Cleaning up a criminal record can be complicated. If you are not sure whether your record qualifies for sealing in Nevada — or for advice about your personal situation — you should contact a qualified criminal law attorney. A good lawyer can guide you each step of the way. In addition, assistance is provided by the Legal Aid Center of Southern Nevada.

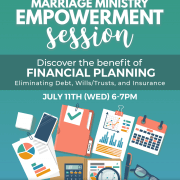

The best cooks use the right ingredients, with the right proportions, to make the best meals! They have mastered the art of getting all the ingredients to work in concert to bring out the most flavor in their dish. Each ingredient adds something extra, that when mixed with the other ingredients, enhances the entire meal. A strong financial plan is no different. Because money affects just about all aspects of our lives we need several different financial ingredients to address different financial needs throughout our lifetime.

Just as a chef knows what they want to make in the kitchen, you should know where you want to go financially. In other words, you should have a vision. The vision you have will give you a target to focus on and provide some directions to your finances. Your financial vision should be too great to just keep it in your head! Write it down! When it is on paper, it is tangible and you can be held accountable for it! And when it is on paper, you can make a budget, or a recipe to detail how you and God are going to accomplish your vision!

All good financial recipes have an element of savings. If you want to win with money, you MUST be a consistent saver. There is no way around it! According to a recent GoBankingRates survey, 69% of Americans have less than $1,000 in savings, and 34% have no money whatsoever. Sporadically, putting money away from time to time is too unstructured and it makes hard to set goals and properly track progress; it throws your recipe off! Consequently, the amount of money you can save is directly related to the money you spend. You MUST get your spending under control and work to eliminate debt in your life. The less debt you have, the more you can save, and the more financially successful you will be!

Many times when financial plans are talked about, insurances are left out of the discussion. Insurances have only one job; to protect the insured. That’s it! They are not meant to be investments (meaning they are not meant to make you money). Insurances cost money, but they help protect your financial future. Did you know medical bills are reported to be the number cause for personal bankruptcies?! When you couple this with the fact that an estimated 40% of Americans rack up debt resulting in medical bills, it is easy to see how not enough money and inadequate insurance coverage can ruin your financial plan.

Every good and complete financial recipe has some form of investing. Although investing may not be an ingredient you add right now because of debt, it needs to be added to your recipe at some point if you ever hope to make progress financially. Investing is the best way to put your money to work. You work hard for your money. Investing allows your money to return the favor! There are many different types of investments with some of the more popular ones being stocks, mutual funds, real estate, and when you include retirement investing you have to consider 401ks, TSPs, IRAs, and the like. Investments create wealth and over time, these investments have proven to be worth more than they cost making them valuable assets in your financial plan.

And the final ingredient in our discussion is a transitioning plan. Building wealth can take a long time. It can even take generations. But all the hard work, saving, investing, and wise decision making can be wasted if it is not properly transferred to the intended beneficiary. This where wills and trust add value to your financial recipe. Wills and trusts allow an estate to be managed in your absence; they help transition your hard-earned wealth as you wish. They help eliminate family feud as they layout specific instructions on how to handle an estate.

The ingredients in this article are not an exhaustive list. There is a lot of details not mentioned that need to be vetted to ensure you are making the best choice for you and your family. Savings, eliminating debt, investing, and estate planning are good money management practices and, at some level, are part of a strong financial plan. So, it’s time to do some reflection on your own financial plan. And we can help you with that! Financial Peace University is being offered at the church again! It will be starting on August 8th (which is a Wednesday night) from 6pm-7pm and will run for 9 consecutive weeks. Registration is open now in the bookstore! If you have any questions, you can email us at legacygroup@mfmnv.org. Come on out and join us. Your financial future cannot wait any longer!

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton HouseCheck schedule for services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2025 Check schedule for special services