| Who’s shopping online for the holidays? If you’re doing any shopping on Amazon and you want to help support MFM, shop at smile.amazon.com, choose Mountaintop Faith Ministries as your designated non-profit and Amazon will make a contribution on your behalf. Best of all it doesn’t cost you anything extra!

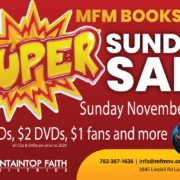

Shop the deals and support the Vision at the same time. |

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton HouseCheck schedule for services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2025 Check schedule for special services