With the deadline quickly approaching in a few short weeks, I thought I would take this time to discuss something we all have to deal with around this time of year; taxes. They say there are only two things guaranteed in life; death and taxes. I’m not a big fan of what “they” say, but in this case, I think “they” got it right. You cannot escape the burden of paying taxes. But is it right to pay taxes? Should we have to surrender a portion of our hard earned money to the state?

The truth is taxes have been used by governments for various purposes for thousands of years. Sometimes the exacting of taxes was beneficial; for instance, in Gen. 41:34, Joseph advised Pharaoh to impose a 20% tax on all of Egypt during the seven years of plenty in preparation for the following seven years of grievous famine. But sometimes taxes were used as a punitive measure. In 2 Kings 23, the nation of Judah was taxed for their attempted rebellion. Regardless of the intent and use of the particular tax levied, history has shown the use of the people’s money to support a governmental agenda is not new and it is even supported biblically. We, the people, have the responsibility and duty to support our government; we just happen to live in a land where we have the opportunity to influence our government’s agenda via the power of our vote.

Now let’s talk about some common tax strategies. Our current tax system is designed to reward the higher income earners with the joy of paying more taxes. The more you make, the more they take! But there is something we can do. We are legally allowed to reduce our earned income by certain expenses to lessen our taxes owed. The most popular deductions taxpayers claim include the following:

1. Charitable Donations

2. Retirement Contributions

3. Interest on College Education Tuition Payments

4. Self-Employment Expenses

5. Mortgage Interest Deductions

These tax deferments can be great, however, you need to understand a little about the system so you can make the best choices and maximize your stewardship. For instance, contributions to a 401k or some other retirement vehicle (such as an IRA) can be deducted from your income to lower taxes owed. That money will grow in the account tax-deferred. But when you pull your money out of the retirement vehicle it will be taxed because it was not taxed when you put the money in the account originally. Remembered, taxes are guaranteed. But consider this: as long as the money is in the account, it will continue to grow. And this is a good thing. If the original money was put in the account tax-deferred, taxes are owed on the growth. And the growth can be substantially larger than the money put in the vehicle. So in that case, it might be better to not take the tax deferment and pay the taxes now because the taxes owed are on a much smaller amount of money. You need to know what works best for you. If retirement is 20-25 years away, it may be best to pay the taxes now. If retirement is 5 years away, and your retirement income will be much smaller than your income now, then you might want to take the tax-deferred option. In either scenario, you only benefit from knowing more about how the system works.

In Matthew 22:21, Jesus tells us “Render unto Caesar the things that are Caesar’s; and unto God the things that are God’s”. It is our obligation to pay taxes, but that does not mean we have to pay more than we should. If we are ever going to be prosperous, we have to learn to be wise with our money and that means taking advantage of all the tax breaks we can. So, use all the benefits you can to keep more of the resource (i.e. money) God has blessed you to do His will. Free yourself to be a more of blessing by being a better steward. God Bless.

Voting is now open for Deacon Reuben Jones Award and Servanthood Award 2018. Cast your vote now til Sept 15th

Winners will be announced in October

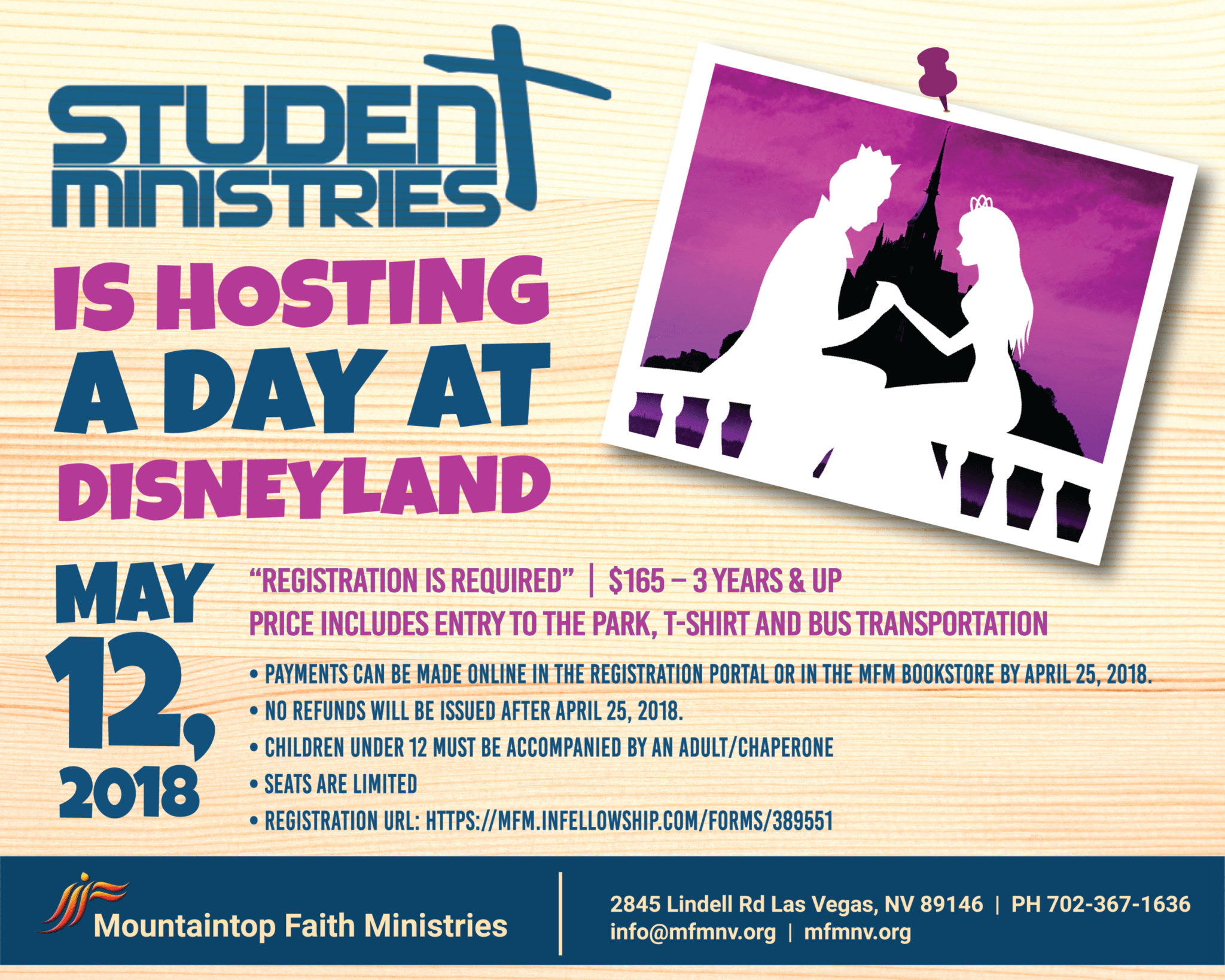

We’re going to Disney Land

/in Past Events/by Andrea SolidRegistration https://bit.ly/2GEDqKA

Children must be accompanied by an adult/chaperone

Seats are limited. Register Now!

Resurrection Carnival Registration

/in Past Events/by Andrea Solid

Register Today https://mfm.infellowship.com/Forms/389794

Pastor House on God TV

/in Past Events/by Andrea SolidIn case you missed it…

|

A few weeks ago Pastor and Aubrey Branch (MFM Board Treasurer) joined Rich Marshall in Orlando as guests on the new God@Work television show. This program, that highlights how God is at work in people’s lives around the world, is produced by GodTV and his segment aired on Monday, February 19th at 5:30 pm PST.

You can watch the episode by clicking the below link

https://www.god.tv/node/27958 |

|

|

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct) Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton HouseCheck schedule for services

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

LOCATION

2845 Lindell Rd

Las Vegas NV 89146

CONTACT

Phone: (702) 367-1636

Fax: (702) 367-4008

SUNDAYS

A Time of Prayer 9:00 am (on campus) 1st Sundays (Feb-Oct)

Worship Service On-Campus & Online 10 am PST

WEDNESDAYS

Bible Study with Pastor Clinton House

Concluded for 2025 Check schedule for special services